Neobank Development: A Guide to Fintech Innovation

The Neobank Phenomenon: Why It's Reshaping the Banking Landscape

You're here because the idea of creating a Neobank has piqued your interest. But let's not just scratch the surface; let's delve into why Neobanks are revolutionizing the banking industry. According to a report by Deloitte, Neobanks are set to disrupt traditional banking models, offering consumers more choices and better experiences.

The Evolving Global Scenario in Neo-Banking

In the last half-decade, the worldwide neo-banking sector has experienced remarkable expansion, both in market size and user engagement. Forecasts suggest that this growth isn't slowing down, with an anticipated increase of at least 25-30% over the upcoming five years.

The unique benefits that neo-banking offers to fintech companies and their customers indicate a bright future for this financial model.

Current trends predict that neo-banking will become a mainstream choice in the near term, as consumer and small business adoption rates continue to climb. Whether it will eventually eclipse traditional banking remains a question for the future.

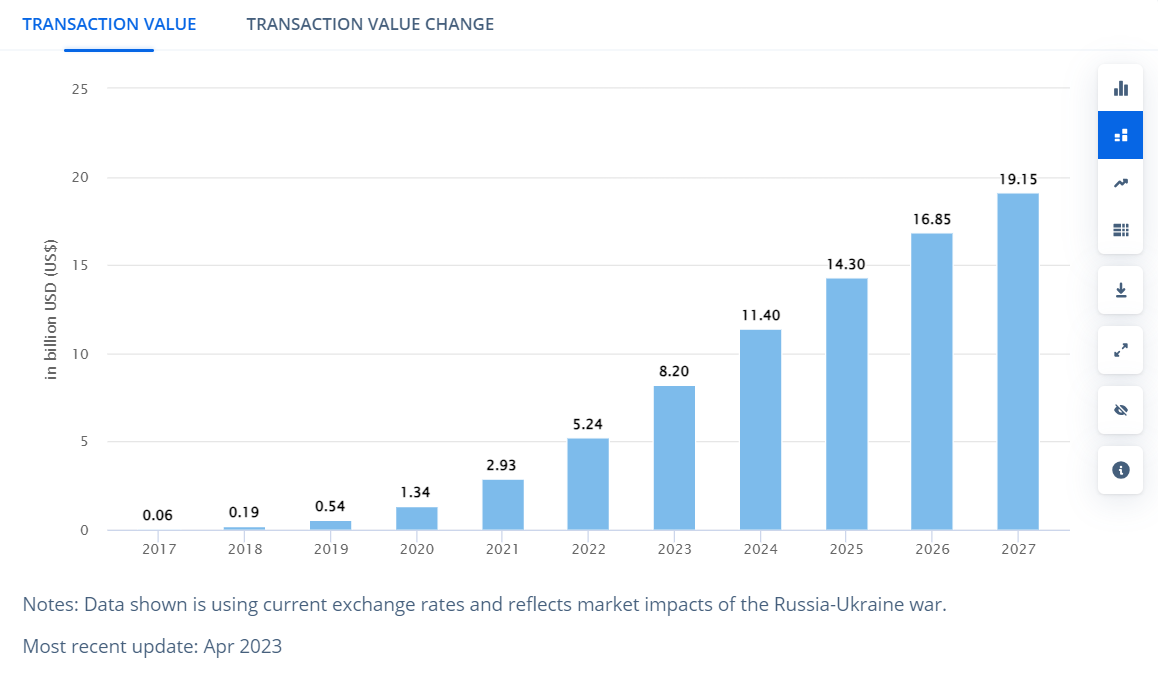

The Future of Neobanking in Saudi Arabia: A Data-Driven Perspective

As the Neobanking landscape continues to evolve, it's crucial to understand its impact on specific markets. In Saudi Arabia, the Neobanking sector is on a trajectory of rapid growth. According to Statista, the transaction value in the Neobanking market is projected to reach a staggering US$8.20 billion in 2023. This growth isn't just a flash in the pan; it's expected to continue at an annual rate of 23.62%, reaching an estimated US$19.15 billion by 2027.

Moreover, the average transaction value per user in the Saudi Neobanking market is anticipated to be US$17.30k in 2023. When compared globally, the highest transaction value is observed in the United States, with a whopping US$1,426.00 billion projected for 2023.

In terms of user engagement, the number of Neobanking users in Saudi Arabia is expected to rise to 724.20k by 2027. The market penetration is predicted to be 1.3% in 2023 and is expected to increase to 1.9% by 2027.

These statistics underscore the immense potential of the Neobanking market in Saudi Arabia, making it a fertile ground for fintech innovation. Whether you're considering a platform-based or customer-centric Neobank, the Saudi market offers promising opportunities for growth and customer engagement.

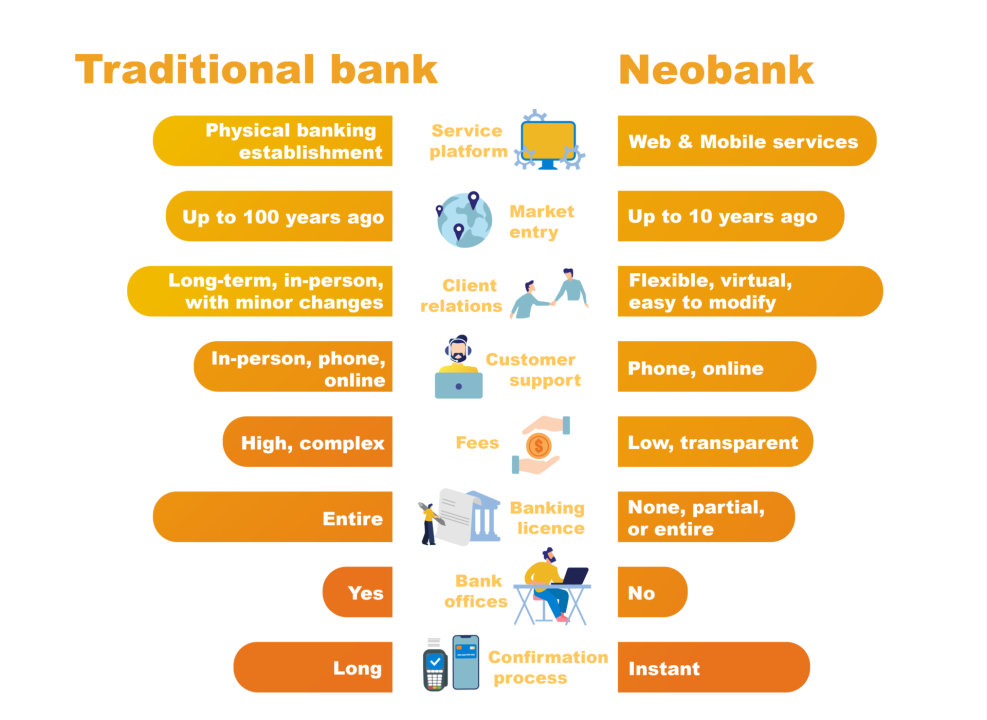

Picking Your Neobank Blueprint: Platform or Customer-Centric?

Your first pivotal choice is between a platform-based Neobank and a customer-centric Neobank. As Forbes reports, platform Neobanks operate with a banking license and manage the entire customer journey. Conversely, customer-centric Neobanks collaborate with traditional banks, putting user experience at the forefront.

The Anatomy of Platform Neobanks

- Banking License: The cornerstone for offering a full suite of banking services. Acquiring a banking license can be a lengthy process, but it provides you with greater control over your financial products.

- Custom Core Banking System: Tailored solutions for a unique customer experience. This involves significant investment in technology but pays off in customer loyalty.

- Data-Driven Insights: Leverage pristine data to understand your customers better. Utilizing machine learning algorithms can further refine your customer targeting.

The DNA of Customer-Centric Neobanks

- Banking Partnerships: No need for a banking license; partner with established institutions. This model allows for quicker market entry but may involve revenue-sharing agreements.

- Ready-Made Core Banking System: Utilize third-party technology for quicker deployment. Companies like Finastra offer robust core banking solutions.

- User Experience: The spotlight is on front-end design and customer interaction. Investing in top-notch UI/UX design can significantly improve customer satisfaction.

Partnering with the Ideal Issuing Bank: A Crucial Step

Choosing the right issuing bank is a critical decision in your Neobank journey, one that can significantly impact both compliance and operational efficiency. As emphasized by Finextra, the ideal issuing bank should align with your business model, whether you're a platform Neobank or customer-centric.

Key Considerations for Choosing an Issuing Bank

-

Regulatory Compliance: Ensure that the issuing bank you choose is compliant with all relevant regulations, including anti-money laundering (AML) and counter-terrorism financing (CTF) laws. This will help you avoid legal complications down the line.

-

Technical Compatibility: The issuing bank should offer APIs that are compatible with your technology stack. This ensures seamless integration and a smoother customer experience.

-

Financial Stability: Look for an issuing bank with a strong balance sheet and a high credit rating. This ensures that your funds are secure and reduces business risk.

-

Fee Structure: Understand the fee structure thoroughly. Hidden fees can eat into your profit margins, so make sure you know what you're getting into.

-

Customer Support: A responsive customer support team can be invaluable, especially in the early stages when you're likely to encounter teething problems.

-

Geographical Coverage: If you plan to expand internationally, choose an issuing bank that can support multiple currencies and has a broad geographical reach.

-

Scalability: As your Neobank grows, your issuing bank should be able to scale its services to match your expanding customer base.

-

Reputation: Last but not least, consider the bank's reputation. Customer reviews and industry accolades can provide valuable insights into the bank's reliability and service quality.

By carefully evaluating these factors, you can form a partnership that not only meets regulatory requirements but also aligns with your business goals and customer needs.

Fortifying Your Neobank: Compliance and Security Protocols

In the banking world, security isn't optional; it's a mandate. Investopedia underscores the importance of Know Your Customer (KYC) protocols for identity validation and risk mitigation. For platform Neobanks, PCI DSS compliance is obligatory, as outlined by PCISecurityStandards.

Crafting the Perfect Neobank App: Features That Matter

- Seamless User Onboarding: It's not just a sign-up page; it's your first impression. Educate users on your app's unique selling points. A/B testing can help refine your onboarding process.

- Versatile Payment Options: From P2P payments to bill settlements, your app should be a financial Swiss Army knife. Mobile Payments Today suggests P2P payments as a non-negotiable feature.

- Intelligent Transaction History: Offer filters for daily, weekly, and monthly spending to help users manage their finances better. Advanced features like predictive analytics can offer spending insights.

- Round-the-Clock Customer Support: Zendesk reports that excellent customer service can skyrocket customer retention rates. Consider implementing AI-driven chatbots for 24/7 support.

The Neobank Development Lifecycle: A Roadmap to Success

- Market Research: Pinpoint market gaps and define your unique selling proposition. Utilize tools like SEMrush for competitive analysis.

- Intuitive UI/UX Design: A design that not only looks good but feels good to use. User testing can provide valuable feedback.

- Robust Development: Front-end and back-end development to translate your vision into reality. Agile methodologies can speed up the development process.

- Quality Assurance: Thorough testing to ensure every feature is up to par. Automated testing can help identify bugs early.

- Launch: Your app is now ready to disrupt the fintech space. A well-planned marketing strategy can ensure a successful launch.

Your Next Steps in Neobanking: Ready to Transform the Industry?

Creating a Neobank isn't just challenging; it's exhilarating. With a user-centric approach and robust security measures, your Neobank can not only meet but surpass customer expectations.

Ready to disrupt the fintech world? Contact iSpectra for unparalleled expertise.