Customer Onboarding: Creating Accessible Banking Experiences

The Gateway to Modern Banking - Customer Onboarding

Welcome to the innovative realm of modern banking, where the customer's journey commences with a crucial step: onboarding. This pivotal process is more than just a formal introduction; it's the cornerstone of the customer-bank relationship. Today's digital advancements have elevated onboarding from a simple procedure to a critical element of customer experience, shaping perceptions and fostering loyalty. In this exploration, we unveil the strategies revolutionizing banking onboarding, emphasizing convenience, efficiency, and personalization, not just as objectives but as essential benchmarks for success.

Current Landscape of Customer Onboarding in Banking

In the contemporary banking landscape, customer onboarding transcends traditional formalities, emerging as a strategic aspect of customer experience. This evolution reflects a deeper understanding of the onboarding process's impact on customer relationships.

The Impact of First Impressions

A report by Aite Group underlines a critical insight: 80% of customers view their onboarding experience as indicative of their long-term engagement with a bank. This finding underscores the crucial role of first impressions in the financial industry, where an efficient and user-friendly onboarding process is key to retaining customers and enhancing satisfaction.

Case Study: Embracing Digital Onboarding

Consider the transformation of Bank of America’s onboarding process, which incorporated digital solutions to streamline customer interactions. This strategic move resulted in increased customer engagement and satisfaction, highlighting the value of digital innovation in onboarding.

As we delve deeper into the nuances of customer onboarding in modern banking, it becomes evident that this initial engagement is pivotal in shaping customer loyalty and brand perception in the banking sector.

Challenges in Customer Onboarding

While customer onboarding is key in banking, it's not without challenges, primarily due to stringent regulatory requirements.

Navigating KYC and Legal Complexities

Banks face the necessity to adhere to detailed Know Your Customer (KYC) regulations. These laws, essential for preventing fraud and money laundering, often extend the onboarding duration, affecting customer experience.

Technological Solutions for Streamlined Compliance

To address these complexities, many institutions are turning to technologies like Artificial Intelligence and blockchain. AI assists in automating data verification processes, while blockchain provides a secure, transparent method for customer data management, significantly simplifying the compliance aspect of onboarding.

Customer Perspectives on Privacy and Security

From the customer's viewpoint, these regulatory steps, while occasionally cumbersome, are crucial for their data security. A survey by Deloitte reveals that customers prioritize privacy and security during onboarding, valuing transparent communication about data usage.

Balancing compliance with an efficient customer experience is crucial. The next sections will delve into how banks can turn these challenges into opportunities to build trust and loyalty.

Components of Seamless Customer Onboarding

A seamless onboarding experience is key to a bank's success, involving more than just compliance; it's about creating a clear, user-friendly journey for the customer.

Simplifying the Process

Effective onboarding breaks down into clear, manageable tasks. Each step should be transparent, guiding customers through necessary procedures, especially when handling sensitive information. For instance, JP Morgan Chase employs a step-by-step onboarding process that clearly explains each requirement, enhancing customer understanding and comfort.

Personalization and Tailored Solutions

Customizing the onboarding experience is vital. After the initial data collection, banks can offer services tailored to individual customer needs. Boston Consulting Group highlights how personalization in banking can improve customer engagement and retention. This approach involves using analytics to understand customer preferences, allowing banks to present relevant products and services.

It all starts from day 1 and understanding your customers.

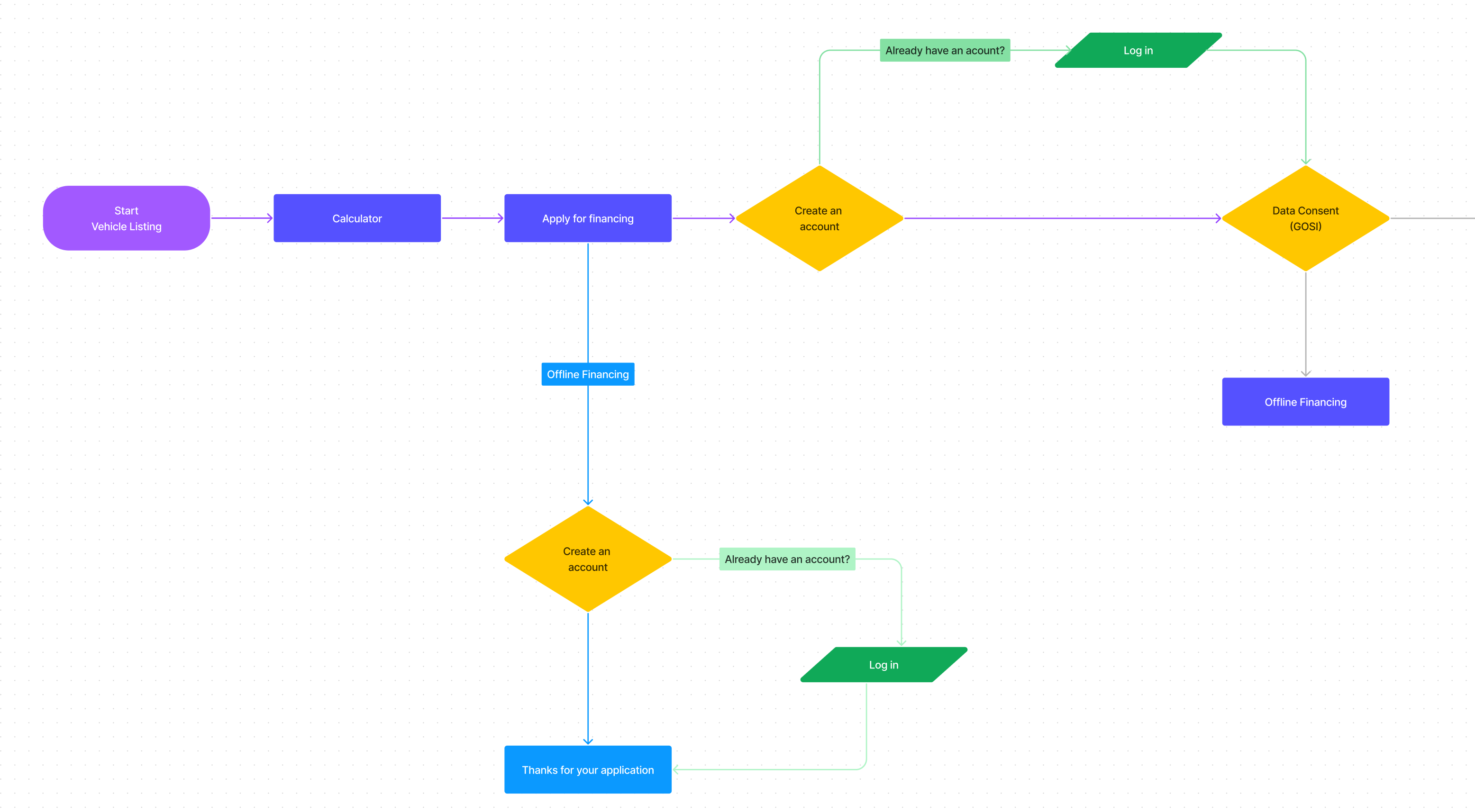

One of our clients had challenges regarding onboarding their customers for a certain digital service provided on their platform. Our UI/UX specialists teamed up with the project's business analyst to do a series of workshops that enabled the UI/UX designers to design for accessibility and convenience from the start.

The following image is an example:

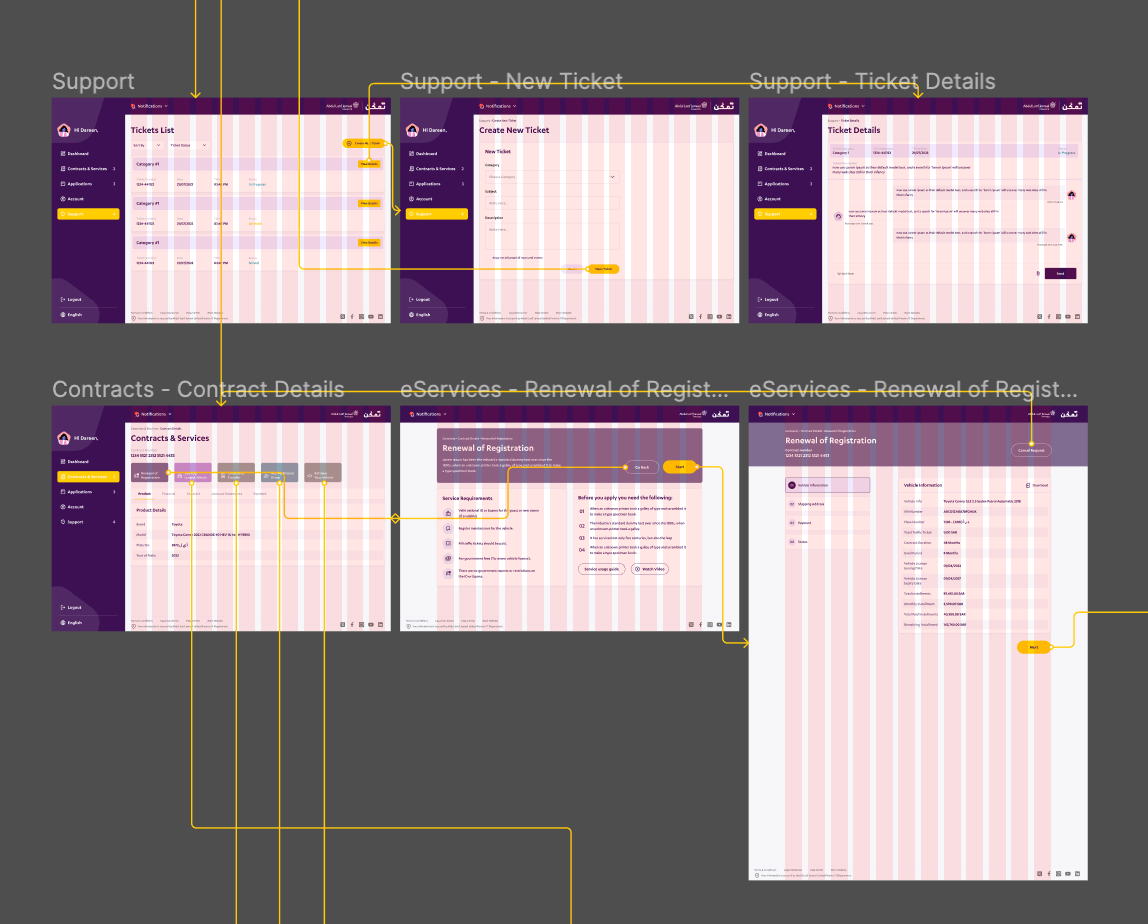

Design and User Experience

The onboarding interface should be intuitive and inviting. Financial institutions like Abdul Latif Jameel Finance (ALJUF) have invested in UX design to ensure their digital platforms are easy to navigate, thereby reducing customer frustration and drop-off rates. Features like progress indicators, simple language, and responsive design are crucial.

Incorporating these elements into onboarding processes enables banks to not just meet but exceed customer expectations, fostering long-term relationships.

Benefits of Seamless Customer Onboarding

A well-structured onboarding process offers significant benefits for both banks and customers.

Integrated Financial Solutions

An efficient onboarding process enables banks to set up multiple functionalities, like bank accounts and credit cards, simultaneously. This integration is beneficial for customers seeking a comprehensive banking solution.

Building Trust and Engagement

A smooth onboarding journey, characterized by a convenient flow and customer-friendly design, lays the foundation for trust and ongoing engagement. McKinsey & Company notes that customer trust in their banks significantly boosts loyalty and the likelihood of using additional services.

Cost Efficiency and Customer Satisfaction

Streamlining the onboarding process not only saves banks time and resources but also enhances customer satisfaction. A quicker, more efficient process, as seen with digital-first banks like Monzo, can lead to higher satisfaction rates due to its ease and speed.

Best Practices for Seamless Customer Onboarding

To create an ideal onboarding experience, banks need to follow certain best practices:

Clear and Understandable Flow

The process should be transparent, with customers aware of their current stage and next steps. American Banker emphasizes the importance of clarity in financial services. Informative tooltips and FAQs can be helpful.

- Progress Indicators: Use clear markers to show customers their progress and next steps.

- Simplified Forms: Design forms that are easy to fill, avoiding unnecessary complexity.

- Transparent Policies: Clearly explain why certain information is required, linking to privacy policies for trust building.

Anticipatory Actions

Banks should inform customers about future requirements, like document submissions, to prepare them in advance.

- Advance Notifications: Inform customers about future steps or required documents in advance.

- Checklists: Provide a checklist of requirements at the start of the process to set clear expectations.

User-Friendly Design

Investing in a design that is easy to navigate is crucial. Institutions like Capital One focus on a customer-centric design approach, ensuring their platforms are accessible and easy to use.

- Responsive Design: Ensure the onboarding interface is accessible on various devices.

- Minimized Steps: Reduce the number of steps required to complete the process.

- Visual Aids: Use icons and images to guide users, especially in complex financial concepts.

Implementing these practices can greatly enhance the customer onboarding experience in banking.

Future Trends and Predictions in Banking Onboarding

As we look towards the future, several emerging trends are set to reshape the landscape of customer onboarding in banking:

- AI and Machine Learning: Banks will increasingly use AI to automate and personalize the onboarding experience.

- Biometric Verification: The use of biometrics for identity verification will enhance security and streamline the process.

- Blockchain Technology: Blockchain could revolutionize KYC processes by providing secure, decentralized data management.

- Mobile-First Approaches: With the rising use of smartphones, mobile-first strategies will become crucial in onboarding.

- Regulatory Technology (RegTech): Advanced solutions to manage compliance more efficiently.

These trends point towards an even more customer-centric, secure, and efficient onboarding process in the future.

Revolutionizing Banking Through Enhanced Onboarding

In conclusion, the evolving landscape of customer onboarding in banking highlights the importance of creating experiences that are not only regulatory-compliant but also customer-centric. By embracing technological innovations, simplifying processes, and prioritizing user experience, banks can significantly enhance customer satisfaction and loyalty. The future of banking onboarding lies in personalization, digital innovation, and a keen focus on user needs. As we move forward, banks that adapt and innovate in their onboarding strategies are poised to lead in customer engagement and satisfaction.

Our team can help you enhance your customer onboarding. Contact us today.

FAQs: Understanding Customer Onboarding in Banking

What is the customer onboarding process in banking?

Customer onboarding in banking is the process through which new clients are introduced to a bank's services and products. This includes verifying customer identity (KYC), setting up accounts, and familiarizing them with banking operations.

What is Internet banking onboarding?

Internet banking onboarding is the digital process of introducing new clients to a bank’s online services. This typically involves online forms, digital identity verification, and providing access to online banking features.

What is a customer onboarding process?

A customer onboarding process is a series of steps a company uses to guide new customers to effectively use and benefit from its products or services. In banking, it includes account setup, regulatory compliance, and initial customer engagement.

What is the key challenge of client onboarding for banking?

The key challenge of client onboarding in banking is balancing strict regulatory requirements, like KYC, with a smooth and efficient customer experience.

What is the biggest challenge in onboarding?

The biggest challenge in onboarding is ensuring a seamless integration of compliance requirements with an intuitive and engaging customer experience.

How can you improve onboarding customers?

Improving customer onboarding can be achieved by:

- Simplifying and streamlining the process.

- Employing technology for efficiency, such as AI and biometrics.

- Personalizing the experience based on customer data.

- Providing clear, informative communication throughout the process.