Top 10 Trends Revolutionizing the Banking Sector

Introduction

Advancements in technology are transforming the banking industry, making it more secure, efficient, and customer-centric. This article delves into the top 10 trends in banking technology, from artificial intelligence to quantum computing, and how they can benefit your business.

Top 10 Trends and Emerging Startups

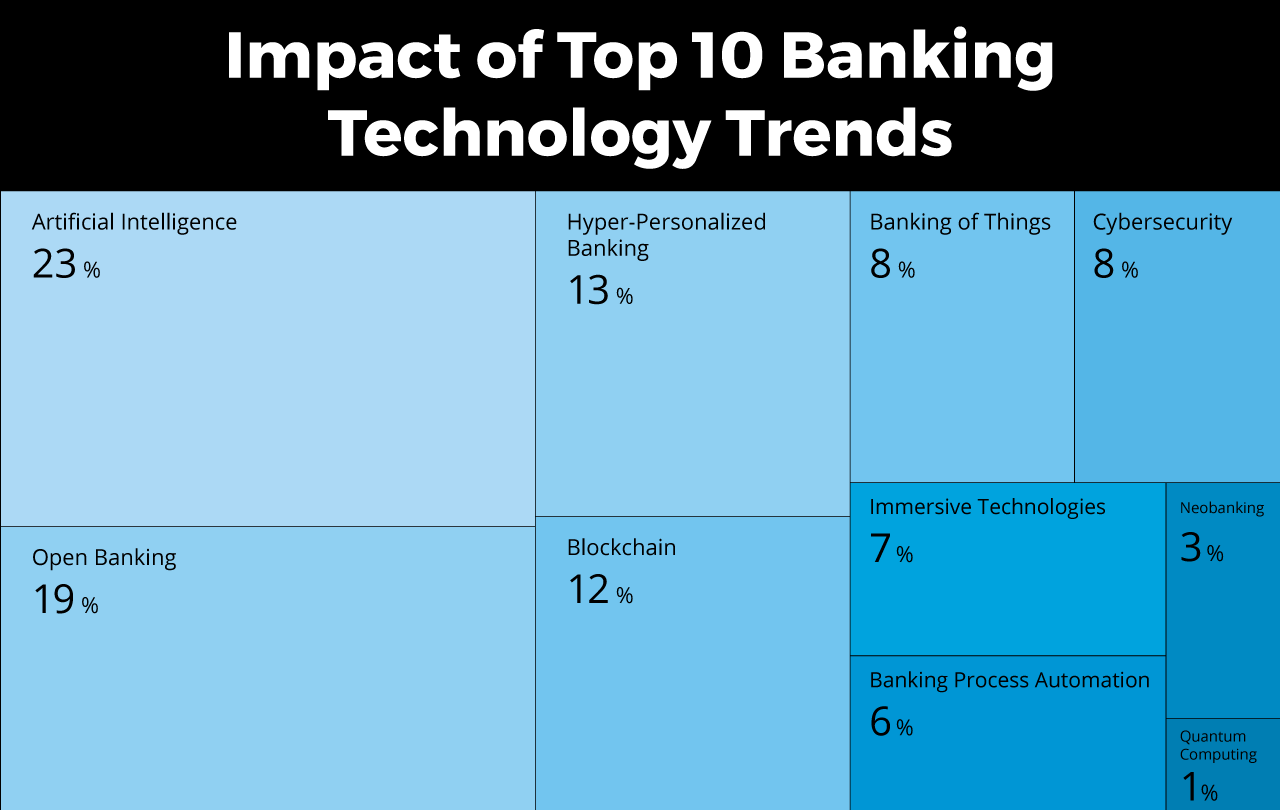

Based on extensive research that analyzed over 1,900 startups worldwide, this article offers valuable insights into the top trends in banking technology. These include:

- Artificial Intelligence (AI)

- Open Banking

- Hyper-Personalized Banking

- Blockchain

- Internet of Things in Banking

- Cybersecurity

- Immersive Technologies

- Automated Banking Processes

- Digital-Only Banks

- Quantum Computing

The Impact of These Trends

AI is revolutionizing customer service through chatbots, while open banking and hyper-personalized services are enhancing customer experiences. Blockchain is adding a layer of security and transparency to transactions, and IoT is enabling real-time financial responses. Cybersecurity measures are increasingly robust, and immersive technologies like AR and VR are making customer interactions more engaging.

Global Startup Landscape

The article also highlights the global distribution of startups that are contributing to these trends. The UK, India, and the US are leading in startup activity in this sector.

Top 10 Trends and Emerging Technologies in Banking

1. Artificial Intelligence (AI)

AI is transforming the banking landscape by automating processes, enhancing customer service, and improving security measures. It's also democratizing financial services by making them more accessible through intelligent credit scoring algorithms.

Use Cases:

- Customer service chatbots

- Fraud detection algorithms

- Intelligent credit scoring

- Personalized financial advice

2. Open Banking

Open banking is dismantling traditional financial silos and fostering a more collaborative environment. By allowing third-party developers to integrate with existing banking platforms, it's creating a more competitive and innovative financial ecosystem.

Use Cases:

- Third-party budgeting apps

- Instant loan approvals

- Seamless money transfers

- Financial data aggregation services

3. Hyper-Personalized Banking

Hyper-personalization in banking is all about tailoring services to individual customer needs. With the help of AI and machine learning, banks can now offer real-time, personalized financial advice, which significantly enhances customer satisfaction and loyalty.

Use Cases:

- Real-time spending alerts

- Personalized investment advice

- Customized loan offers

- Tailored financial wellness programs

4. Blockchain

Blockchain is revolutionizing financial transactions by adding a new layer of security and transparency. It's particularly impactful in cross-border payments, where it eliminates the need for intermediaries and significantly reduces transaction costs.

Use Cases:

- Cross-border payments

- Smart contracts

- Decentralized finance (DeFi)

- Transparent auditing

5. Internet of Things (IoT) in Banking

IoT is automating various aspects of banking, from data collection to fraud detection. Smart devices are becoming increasingly integral in gathering valuable data that enhances customer experiences and improves security measures.

Use Cases:

- Smart ATMs

- Real-time fraud detection

- Automated customer service kiosks

- IoT-enabled payment systems

6. Cybersecurity

In an increasingly digital world, robust cybersecurity measures are essential. Advanced security protocols, coupled with AI-powered fraud detection systems, are making digital banking more secure than ever.

Use Cases:

- Two-factor authentication

- Biometric security measures

- AI-powered fraud detection

- Secure cloud storage

7. Immersive Technologies

Immersive technologies like AR and VR are enhancing customer interactions and employee training. They offer a more engaging and interactive experience, making banking more relatable and less intimidating.

Use Cases:

- Virtual customer service desks

- AR-based account management

- VR employee training programs

- Interactive financial planning tools

8. Automated Banking Processes

Robotic Process Automation (RPA) is streamlining various banking processes, making them more efficient and error-free. Automation is reducing the need for manual intervention in repetitive tasks, allowing employees to focus on more complex, value-added activities.

Use Cases:

- Automated data entry

- Streamlined customer onboarding

- Automated compliance checks

- Efficient transaction processing

9. Digital-Only Banks

Digital-only banks are a response to changing consumer preferences. Operating entirely online, they offer all the services of a traditional bank but at a fraction of the cost, making banking more convenient and accessible.

Use Cases:

- Online account management

- Virtual financial advisors

- Digital loan applications

- Mobile payment solutions

10. Quantum Computing

Quantum computing is still in its nascent stage but holds immense potential for the banking sector. Its ability to perform complex calculations at unprecedented speeds will revolutionize data analysis and financial modeling.

Use Cases:

- Advanced risk assessment

- Real-time market analysis

- Optimized trading algorithms

- Secure cryptographic systems

Conclusion

Technological trends like AI, open banking, and big data are making banking more efficient and secure. These advancements are set to redefine the banking industry, offering new opportunities for growth and innovation.

Ready to embrace the future of banking technology and stay ahead of the curve? Don't miss out on leveraging these game-changing trends for your financial success. Contact us now to discuss how we can help you navigate the rapidly evolving banking landscape.

Learn more: