The Evolution of Digital Banking in Saudi Arabia

Digital Banking in Saudi Arabia: The Future of Finance in the Kingdom

Digital banking is revolutionizing the financial landscape in Saudi Arabia, aligning with the country's Vision 2030 to diversify the economy and promote technological advancements. This comprehensive guide delves into the intricacies of digital banking in Saudi Arabia, from its types and benefits to challenges and future prospects.

Types of Digital Banking

The digital banking ecosystem in Saudi Arabia is diverse, offering various types of services to meet the evolving needs of consumers. Here are the primary types:

- Online Banks: These are banks without physical branches, offering services entirely online.

- Neo-Banks: These are fintech startups that offer banking services but do not have a banking license.

- Challenger Banks: These are smaller, newer banks that challenge established traditional banks.

- Banking-as-a-Service (BaaS): This is an end-to-end process ensuring the smooth running of banking services over the internet.

According to a report by KPMG, neo-banks hold a market share of 20% in Saudi Arabia's digital banking sector, while online banks have a 30% market share. Banking-as-a-Service is expected to reach a market valuation of $7 trillion by 2030, growing at a rate of 26% year-on-year.

Need help with your bank's digital transformation? Contact our consultants today.

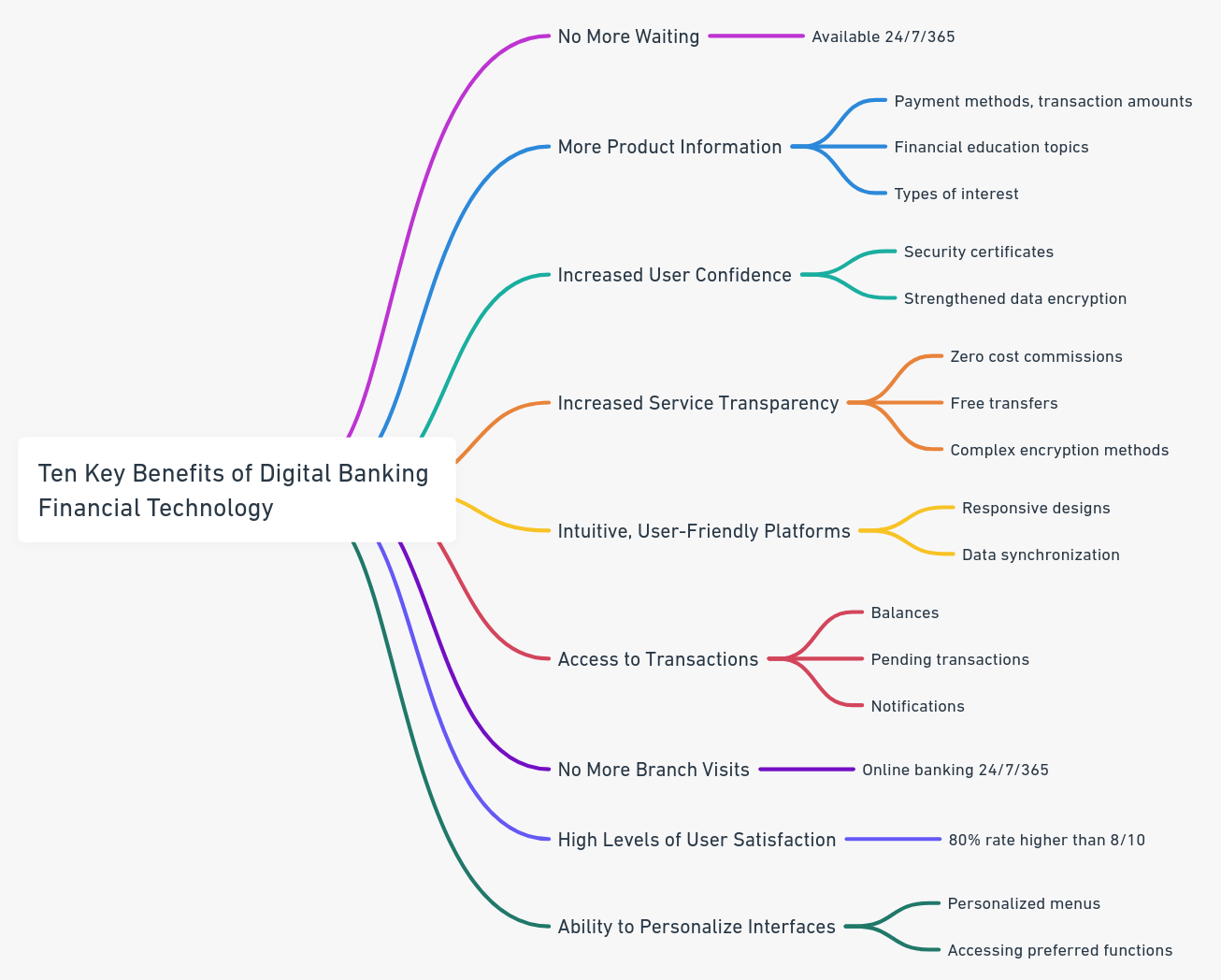

Benefits of Digital Banking

Digital banking offers numerous advantages, such as convenience, lower fees, and quick transactions. Here are some key benefits:

- Easy Access

- Cost-Effectiveness

- Speed and Efficiency

- Enhanced Security

- ... and much more.

Technologies Powering Digital Banking in Saudi Arabia: A Deep Dive

The digital banking sector in Saudi Arabia is not just about shifting traditional banking services to an online platform; it's about leveraging cutting-edge technologies to redefine how financial services are structured, delivered, and consumed. In this section, we'll explore the key technologies that are driving this transformation.

Artificial Intelligence (AI) and Machine Learning

Applications

- Predictive Analytics: AI algorithms analyze customer data to predict future behaviors, such as spending patterns or loan default risks.

- Chatbots: AI-driven chatbots handle customer queries, reducing the need for human intervention.

Impact

AI and Machine Learning are making banking more efficient and personalized. For example, Riyad Bank has implemented AI to offer personalized financial advice to its customers.

Application Programming Interfaces (APIs) and Microservices

Applications

- Open Banking: APIs allow third-party developers to create apps and services around the financial institution.

- Payment Gateways: Secure and seamless payment transactions are facilitated through APIs.

Impact

APIs and microservices enable a more interconnected financial ecosystem, aligning with the Saudi Vision 2030's focus on fostering innovation in the fintech sector.

Blockchain Technology

Applications

- Smart Contracts: These self-executing contracts with the terms directly written into code can automate many banking processes.

- Identity Verification: Blockchain can provide a more secure and immutable system for identity verification.

Impact

Blockchain offers enhanced security and transparency, making it a cornerstone for future banking systems. For instance, the Saudi Central Bank has been exploring blockchain for cross-border payments.

Cybersecurity Measures

Applications

- Data Encryption: Protecting sensitive customer data.

- Firewalls and Intrusion Detection Systems: To monitor and control incoming and outgoing network traffic.

Impact

As digital banking becomes more prevalent, the importance of robust cybersecurity measures cannot be overstated. Financial institutions in Saudi Arabia are investing heavily in cybersecurity to protect against data breaches and fraud.

Internet of Things (IoT)

Applications

- Wearable Technology: Devices like smartwatches can now perform contactless payments.

- Smart ATMs: IoT-enabled ATMs can offer more functionalities and can be managed remotely.

Impact

IoT is making banking more accessible and integrated into the daily lives of consumers. Al Rajhi Bank, for example, has introduced IoT in its operations to enhance customer experience.

Challenges and Solutions

While digital banking offers numerous advantages, it also presents challenges that need to be addressed for its sustainable growth.

Modernization Challenges for Traditional Banks

Traditional banks in Saudi Arabia are facing challenges in modernizing their legacy IT systems and processes. The slower product development cycles contrast starkly with the nimbleness of fintech startups.

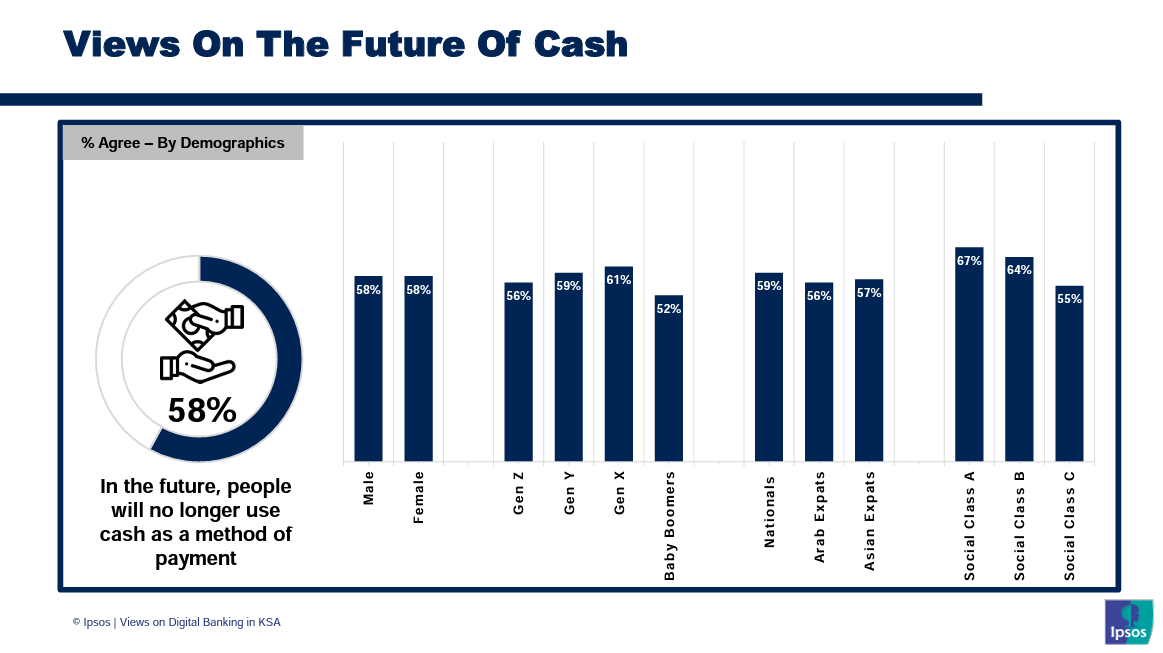

According to a study by Ipsos, 47% of consumers trust mobile service providers for financial transactions, indicating a shift in consumer trust from traditional banks.

Navigating Digital Disruption

Neo-banks and fintech startups present formidable competition to traditional banks. Apps like STC Pay and Mobily Pay offer seamless experiences underpinned by cutting-edge technology.

As per a report by FinTech Saudi, STC Pay has registered as the first financial technology company licensed by SAMA and has become the largest digital wallet in the MENA region.

Future of Digital Banking in Saudi Arabia

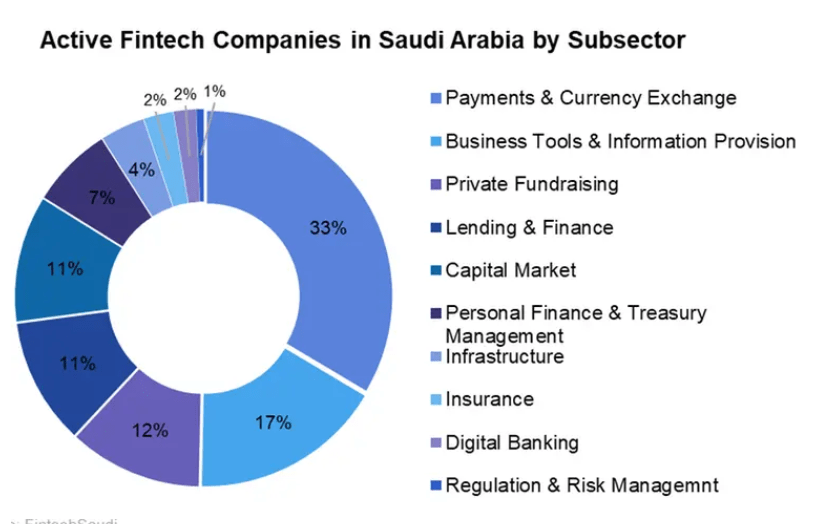

The future of digital banking in Saudi Arabia is promising, with significant investments in fintech and a young, tech-savvy population. The sector is aligned with Saudi's Vision 2030 goals of modernizing the economy and developing robust financial services.

As per SAMA's FinTech Regulatory Sandbox, 11 fintechs were permitted to operate in the 2020 cohort, indicating a growing interest in digital banking solutions.

The Road Ahead: Why Digital Banking is the Future of Finance in Saudi Arabia

Digital banking in Saudi Arabia is not just a trend but a necessity, driven by consumer demand and technological advancements. With the backing of Vision 2030 and a booming fintech sector, digital banking is set to redefine the future of finance in the Kingdom.

The future of digital banking in Saudi Arabia is promising, with a focus on customer-centric solutions, regulatory support, and technological innovation. The Kingdom aims to reach a SAR13.3 billion ($3.6 billion) direct GDP contribution by 2030 from the fintech sector, which will account for 18,200 direct jobs and reach 525 active fintech companies.

Need help realizing your digital banking objectives? Contact iSpectra today.

Author: Firas Ghunaim, a marketing professional with 12+ years of experience in B2B marketing and helping MENA-based financial institutions with transforming their digital infrastructure to deliver the ideal digital user experience for their clients.