Mastering KYC: A Guide to Enhancing Financial Security

Introduction

KYC: Navigating the Essentials of Customer Verification

In an era where digital transactions shape the backbone of global commerce, the concept of 'Know Your Customer' (KYC) has transcended its traditional boundaries, evolving into a critical tool in the arsenal of financial institutions and businesses worldwide. At its core, KYC is more than just a compliance requirement; it's a strategic framework vital for safeguarding the integrity of financial systems and fostering trust in the burgeoning digital economy.

Join us as we delve into the world of KYC, demystifying its processes, understanding its impact on various industries, and uncovering the challenges and innovative solutions shaping its future.

Understanding KYC

What is KYC?

KYC, an acronym for 'Know Your Customer,' is a regulatory and legal framework designed primarily for financial institutions to prevent identity theft, financial fraud, money laundering, and terrorist financing. Originating as a part of the USA Patriot Act post-9/11, KYC policies have now become a global standard for monitoring and verifying the identity of clients, both individual and corporate.

Global KYC Requirements and Regulations

Globally, KYC regulations vary, yet they share a common goal: ensuring the legitimacy of financial transactions and client relationships. In the EU, the Anti-Money Laundering Directives (AMLD) govern KYC requirements, while in the USA, the Bank Secrecy Act (BSA) and USA Patriot Act set the standards. Similarly, other countries have their respective regulatory frameworks aligned with the Financial Action Task Force (FATF) recommendations.

KYC’s Role in Businesses and Financial Institutions

A Shield Against Financial Crimes

For financial institutions, KYC is not just about compliance; it's a crucial line of defense against illicit activities. By verifying the identity of their customers and understanding their financial behaviors, institutions can detect and prevent unlawful transactions.

Beyond Compliance – A Trust Builder

In the digital age, KYC also plays a vital role in building customer trust. A robust KYC process reassures customers that their financial partners are committed to safeguarding their assets and personal information.

The Evolving Scope of KYC

Initially focused on banks and financial entities, KYC now extends to various sectors, including fintech, e-commerce, and online gaming. This expansion is a response to the growing digital economy and the diversification of financial services.

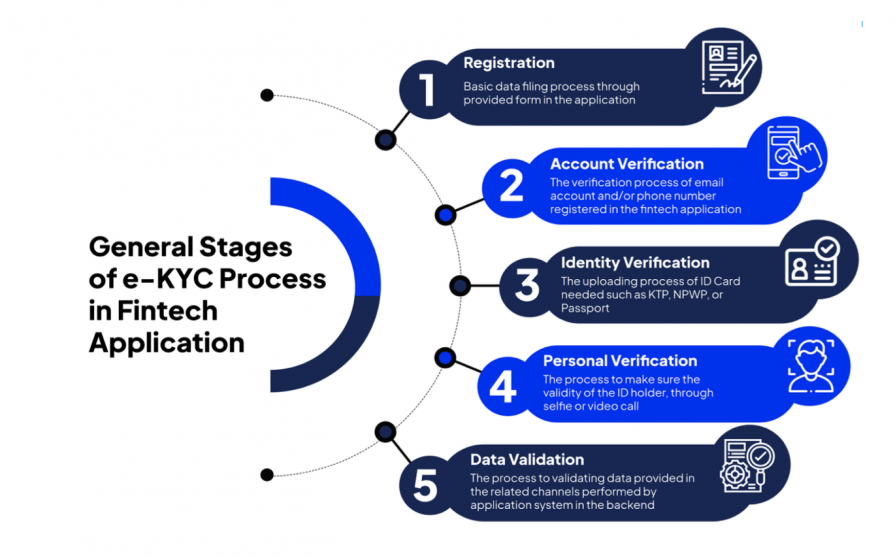

The KYC Process

Unraveling the Steps in KYC Verification

Step-by-Step KYC for Individuals

- Identity Verification: The first step involves verifying the customer’s identity using official documents like passports, ID cards, or driver’s licenses.

- Address Verification: This step confirms the customer’s residential address through utility bills, bank statements, or government-issued documents.

- Background Checks: To ensure the customer is not involved in any illegal activities, financial institutions conduct background checks against global watchlists, criminal records, and sanction lists.

KYC for Corporations: More Than Just Identity Verification

- Understanding Beneficial Ownership: Identifying individuals who ultimately own or control the corporate entity.

- Entity Verification: Verifying the legal status of the business through registration documents, articles of incorporation, and ownership structures.

- Ongoing Monitoring: Regular checks are essential to ensure continued compliance, especially for high-risk clients.

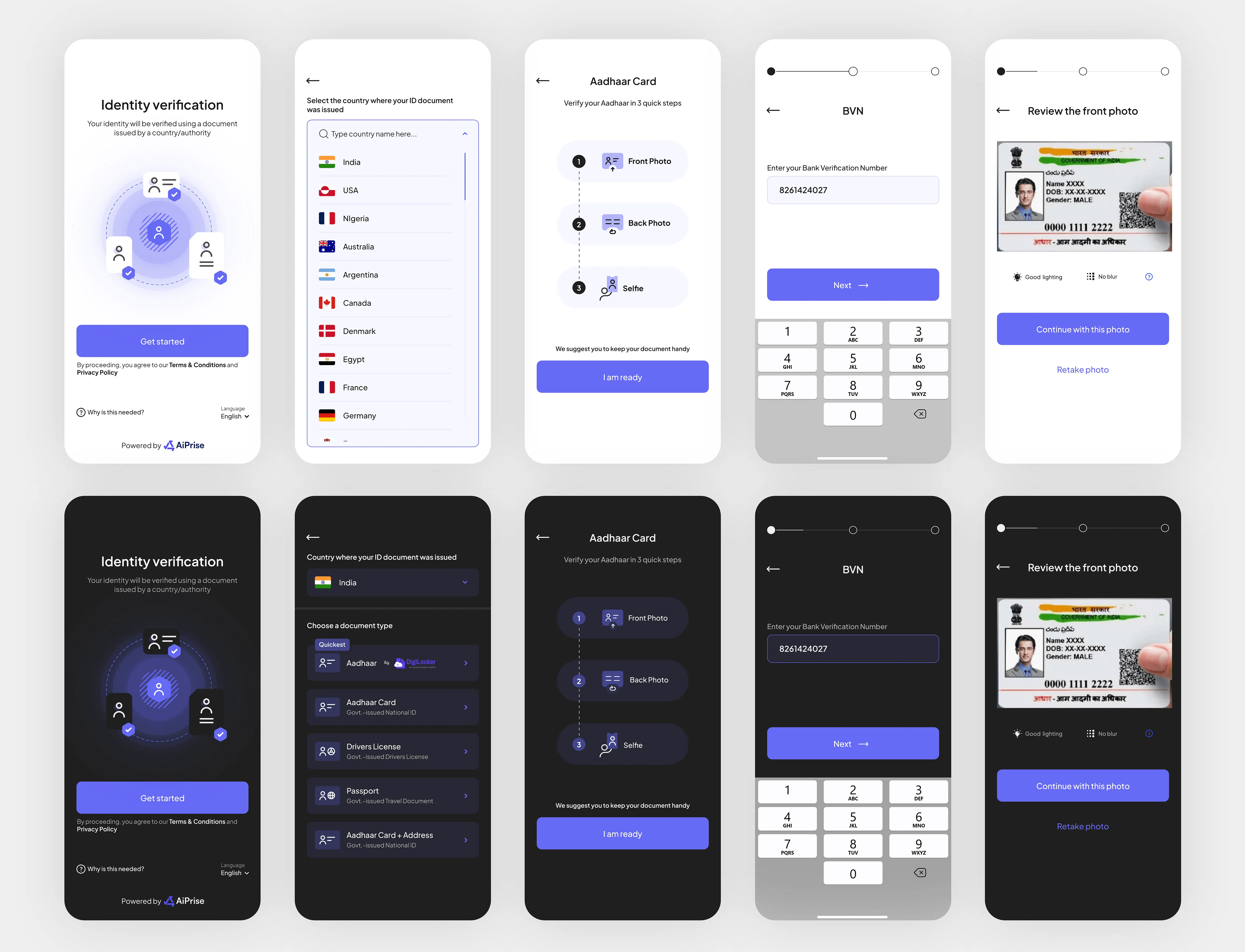

Digital KYC: A New Era of Verification

- Remote Identity Verification: The advent of digital KYC allows institutions to verify identities through video calls, online document uploads, and biometric verification.

- Automated Document Verification: Using AI-driven tools to scan, read, and verify documents, reducing manual errors and speeding up the process.

KYC in the Age of Data Privacy

In an era where data privacy is paramount, KYC processes are designed to be secure and compliant with regulations like GDPR. Ensuring the protection of personal data while conducting thorough checks is a delicate balance that financial institutions must maintain.

Advanced KYC Methods

Embracing Technological Innovations in KYC

Digital KYC: A Game-Changer

The shift towards digital KYC has revolutionized the verification process. By leveraging online platforms, businesses can conduct KYC remotely, enhancing customer convenience without compromising security.

AI and Machine Learning: Predictive Analysis and Efficiency

Artificial Intelligence (AI) and Machine Learning (ML) play pivotal roles in modern KYC strategies. These technologies enable predictive risk assessment, pattern recognition in financial behaviors, and automation of repetitive verification tasks, significantly enhancing efficiency and accuracy.

Biometric Verification Systems: The Next Frontier

Biometrics such as fingerprint scanning, facial recognition, and iris scans offer an additional layer of security in identity verification. These methods are increasingly integrated into KYC processes, particularly in mobile banking and online financial services.

Blockchain in KYC: Enhancing Transparency and Security

Blockchain technology offers a decentralized and transparent approach to storing and verifying customer data, potentially transforming the KYC landscape with its immutable and transparent ledger system.

KYC Compliance Software: Streamlining the Process

The use of specialized KYC compliance software has become commonplace. These platforms integrate various verification tools, regulatory databases, and risk assessment algorithms, offering a comprehensive solution for KYC compliance.

KYC Challenges and Solutions

Navigating the Complexities of KYC

The Challenge of Compliance and Complexity

- Global Regulatory Variations: Navigating the varied and constantly evolving KYC regulations across different jurisdictions is a significant challenge.

- Data Accuracy and Management: Ensuring the accuracy and secure management of vast amounts of sensitive customer data is crucial but often complex.

Innovative Solutions to KYC Challenges

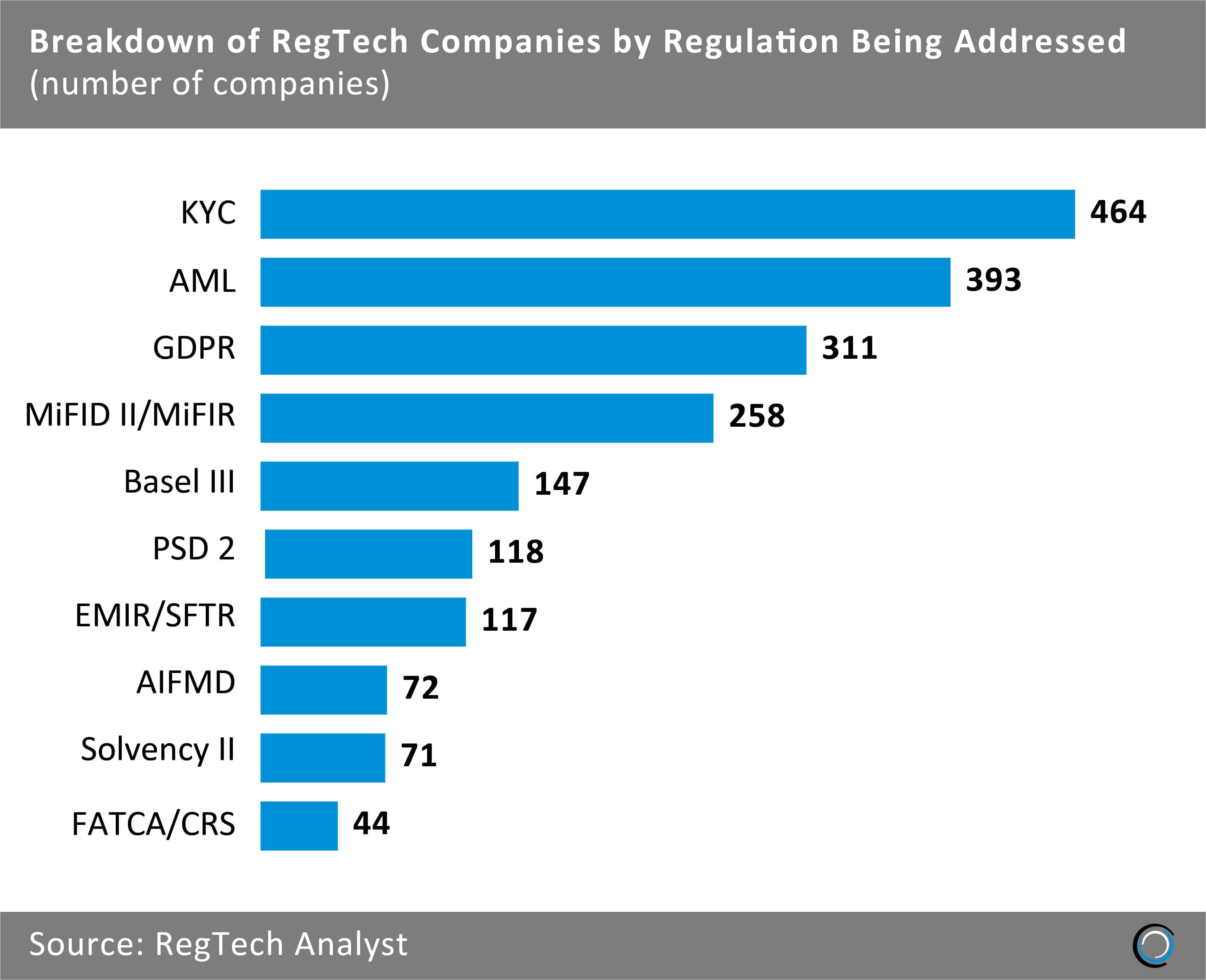

- RegTech Solutions: Regulatory Technology (RegTech) solutions streamline compliance by offering automated updates and alerts on regulatory changes worldwide.

- Advanced Data Security Measures: Implementing robust encryption, blockchain technology, and secure cloud storage to safeguard customer data.

The Future of KYC: Trends and Predictions

- Predictive KYC Models: Leveraging AI and ML for predictive risk management and customer behavior analysis.

- Integrated KYC Platforms: The rise of comprehensive KYC platforms that offer end-to-end solutions from customer onboarding to ongoing monitoring.

Enhancing Customer Experience While Maintaining Compliance

Balancing the rigorous demands of KYC compliance with the need for a seamless customer experience is key. Digital solutions and customer-centric approaches play a vital role in achieving this balance.

KYC and Customer Experience

Optimizing KYC for Enhanced User Engagement

The Impact of KYC on Customer Onboarding

- First Impressions Matter: The KYC process is often the first significant interaction a customer has with a financial service. A streamlined, user-friendly KYC process can set the tone for the entire customer relationship.

- Reducing Abandonment Rates: Simplifying the KYC process, particularly in digital platforms, is crucial to prevent potential customers from abandoning the onboarding process due to complexity or time consumption.

Best Practices for Seamless KYC Experience

- User-Centric Design: Ensuring the KYC process is intuitive and easy to navigate.

- Speed and Efficiency: Leveraging technology like AI and biometrics to expedite the process without compromising accuracy.

- Clear Communication: Providing customers with clear instructions and information on the KYC process and its importance.

Building Trust Through Robust KYC

- Transparency and Security: Demonstrating a commitment to security and compliance through robust KYC practices builds customer trust and confidence in the institution.

- Data Privacy Compliance: Adhering to global data privacy standards (like GDPR) in KYC processes reassures customers about the safety of their personal information.

KYC's Role in Long-Term Customer Relationships

KYC is not just a regulatory requirement; it's an opportunity to understand the customer better. This understanding can lead to more personalized services and, consequently, stronger customer loyalty.

FAQs Section: Addressing Common KYC Queries

1. What is KYC and why is it important? KYC, or 'Know Your Customer,' is a process used by financial institutions and other businesses to verify the identity of their clients. It's essential for preventing identity theft, financial fraud, money laundering, and terrorist financing.

2. How is digital KYC different from traditional KYC? Digital KYC uses online tools and technologies like biometrics, AI, and machine learning to verify customer identities remotely, making the process faster and more user-friendly compared to traditional, in-person verification methods.

3. What documents are typically required for KYC? Commonly required documents include government-issued photo IDs (like passports or driver’s licenses), proof of address (like utility bills or bank statements), and in the case of corporate KYC, business registration and ownership documents.

4. Is KYC mandatory for all financial transactions? While not all transactions may require KYC, it is a standard practice for opening bank accounts, conducting large financial transactions, and using financial services to ensure compliance with anti-money laundering laws.

5. How do companies ensure data security during the KYC process? Companies use advanced security measures like data encryption, secure cloud storage, and compliance with data protection regulations to ensure the safety and confidentiality of personal information collected during the KYC process.

6. Can KYC processes impact customer experience? Yes, an efficient and user-friendly KYC process can enhance customer experience by making onboarding smoother and demonstrating the company's commitment to security and compliance.

Conclusion: Embracing the KYC Journey for a Secure Financial Future

In conclusion, KYC is a dynamic and vital element of the modern financial landscape, serving as the guardian of trust and security in an increasingly digital world. As technologies evolve and customer expectations rise, the importance of a robust, efficient, and user-friendly KYC process becomes ever more critical. Businesses that embrace these challenges and opportunities will not only comply with global regulations but also forge stronger, more trusting relationships with their customers.

For further insights into KYC and its evolving landscape, keep exploring our resources and stay informed on the latest trends and best practices.