Regulatory Compliance in Finance: Leveraging Digital Platforms

Navigating the intricate landscape of regulatory compliance in the financial sector? If you're involved in Saudi Arabia's financial services, understanding how to stay compliant amidst evolving regulations is key. But how exactly do organizations navigate these ever-changing demands?

Consider this: In a world where cybersecurity and data breaches are front and center, custom solutions, software and digital platforms aren't just helpful – they're essential.

These custom solutions:

- Facilitate adherence to data privacy regulations.

- Use advanced technology for ease of compliance.

- Keep you updated with the latest regulatory changes.

Imagine a scenario where an organization effortlessly adapts to new regulations, thanks to a digital platform. This isn't just a possibility; it's a reality for those who embrace these technologies.

Digital platforms do more than just ensure compliance. They're integral in:

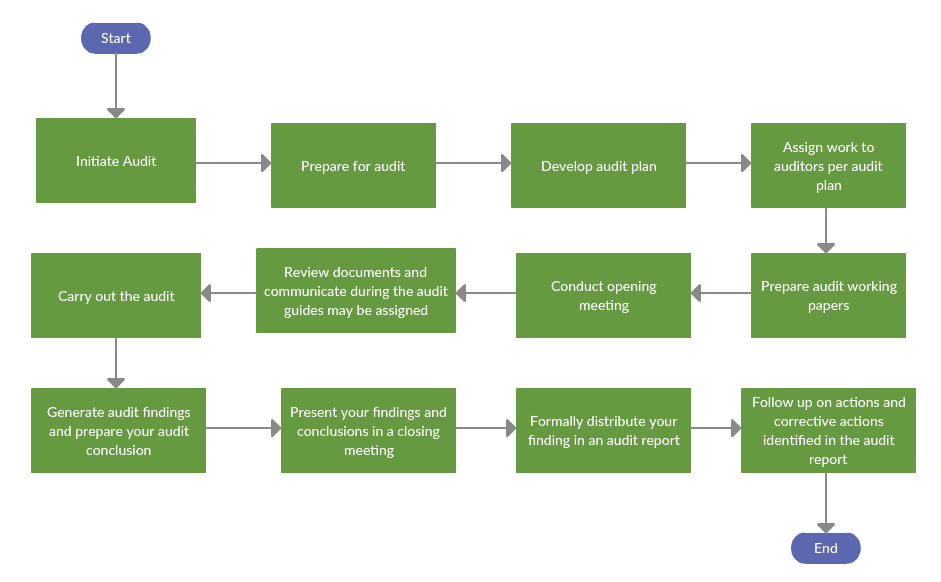

- Streamlining audit processes.

- Enhancing digital strategies.

- Simplifying complex compliance procedures.

- Offering real-time support through automation.

At the forefront of this transformation are compliance officers. Their role? Implementing best practices and conducting thorough audits.

In this article, we dive deeper:

- How Digital Platforms Assist: We'll explore their role in adapting to audits and regulatory shifts and in developing comprehensive digital strategies.

- Expert Insights: Through a case study and expert opinions, we'll evaluate the benefits and risks of digital solutions in regulatory compliance.

- User Experience Analysis: We'll assess how these solutions handle privacy regulations, audits, and the repercussions of non-compliance.

Navigating Compliance in Finance: A Key Focus

Grasping Compliance Complexities

In Saudi Arabia's banking sector, steering clear of compliance pitfalls is paramount to sidestep severe outcomes like reputational damage, hefty fines, or legal troubles.

Navigating compliance is similar to solving a multifaceted puzzle.

Banks and other financial institutions face the daunting task of understanding and adhering to an array of regulatory demands. This encompasses not just audits and data privacy regulations but also the broader banking landscape.

In summary, the key points to consider include:

- Comprehensive Understanding: Delve into the depths of regulatory requirements, audits, data privacy, and the banking framework.

- Complex Frameworks: Banks and financial institutions navigate complex compliance processes.

- Risks of Non-Compliance: The stakes are high with risks like reputational harm, fines, and legal issues.

Central Regulations Guiding the Financial Sphere

Saudi Arabia's financial institutions, including banks and insurers, should persistently fine-tune their compliance processes. This meticulous effort ensures they align with key finance industry regulations.

Robust and custom digital financial platforms are emerging as critical allies in this endeavor.

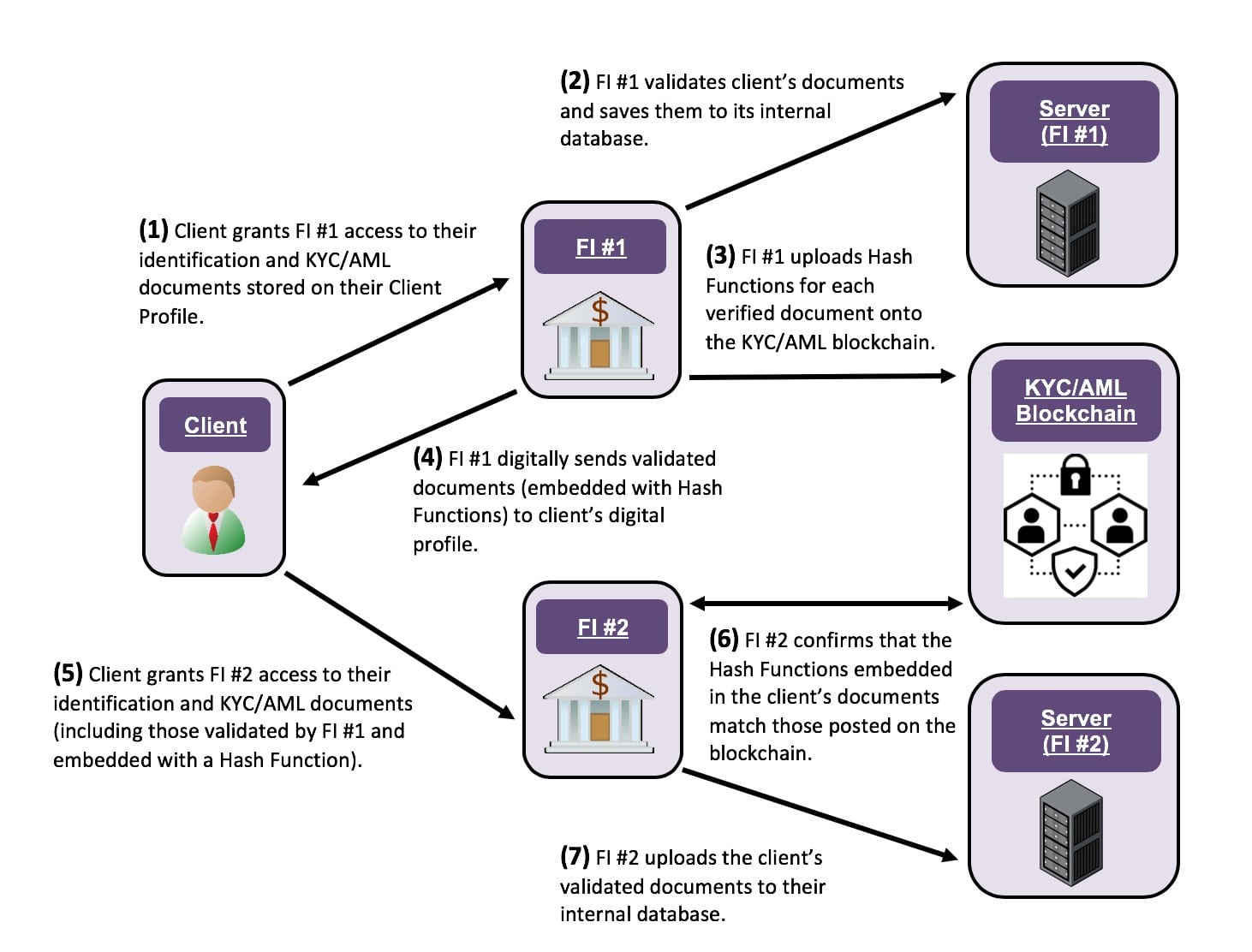

They offer indispensable tools for effective monitoring, reporting, and automating compliance-related tasks, including the vital KYC (Know Your Customer) requirements.

This approach is not just about staying compliant; it’s about safeguarding the trust of customers and the integrity of financial markets. Here’s how to do it:

- Streamlining Processes: Regularly updating compliance processes and reporting.

- Digital Tools for Compliance: Utilizing digital platforms to manage KYC requirements and automate compliance tasks.

- Protecting Customer Trust: Ensuring customer data is secure and private.

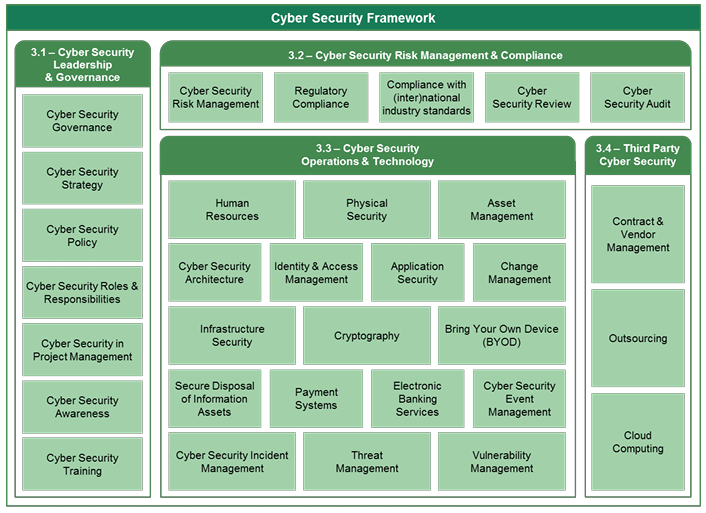

Ethics and Governance: Pillars of Compliance

In the financial sector, ethical conduct and governance are not just good practices; they are the backbone of compliance. Open banking has amplified the importance of data privacy and security. Banks must now prioritize these aspects more than ever to maintain customer trust and protect sensitive information.

Robust governance is vital in the financial sector. Consider the following:

- Necessity of Robust Oversight: Ensuring adherence to regulatory guidelines.

- Digital Platforms' Role: Offering features like automated alerts and real-time reporting for governance.

- Navigating the Fintech Landscape: Utilizing digital solutions to confidently manage compliance in Saudi Arabia’s Fintech-driven financial environment.

Expert service providers like iSpectra are stepping up, offering innovative solutions for regulatory compliance reporting - enabling financial entities to enforce ethical standards, ensure transparency, and monitor for illicit activities such as money laundering.

Digital Platforms as Compliance Navigators

Role in Streamlining Compliance

Developing digital tools and platforms tailored to your requirements (short and long term) are crucial for ensuring that organizations can effectively manage and meet all regulatory requirements.

These platforms have the ability to automate repetitive tasks in the financial services industry, improving efficiency and reducing human error for organizations with the help of custom software developers.

Adopting automation through digital platforms leads to strategic resource allocation and maximizing compliance efficiency:

- Shifting Focus to Analysis and Risk Identification: Compliance teams can concentrate on data analysis and identifying potential risks, rather than administrative tasks.

- Proactive Compliance Management: This approach fosters a proactive stance in managing compliance, enhancing the effectiveness of resources within the financial services industry.

- Ongoing Support and Maintenance: Consistent support and upkeep of these digital platforms are essential to reap these benefits and maintain operational efficiency.

By digitizing compliance procedures in the financial services industry, organizations can enhance collaboration and communication among stakeholders through various digital tools.

Advantages of Automation in Compliance

Automation significantly reduces the likelihood of errors that may occur within the financial services industry during complex compliance procedures.

Automation brought by digital platforms in the financial services sector offers numerous advantages:

- Reducing Errors: Automation minimizes the risk of errors during complex compliance processes.

- Improving Accuracy and Reliability: With less dependence on manual tasks, compliance efforts become more accurate and dependable.

- Resource Optimization: Automation frees up resources, allowing teams to focus on strategic compliance activities rather than manual data processing.

This shift in the financial services industry allows for a more proactive approach to compliance management while maximizing the effectiveness of available resources.

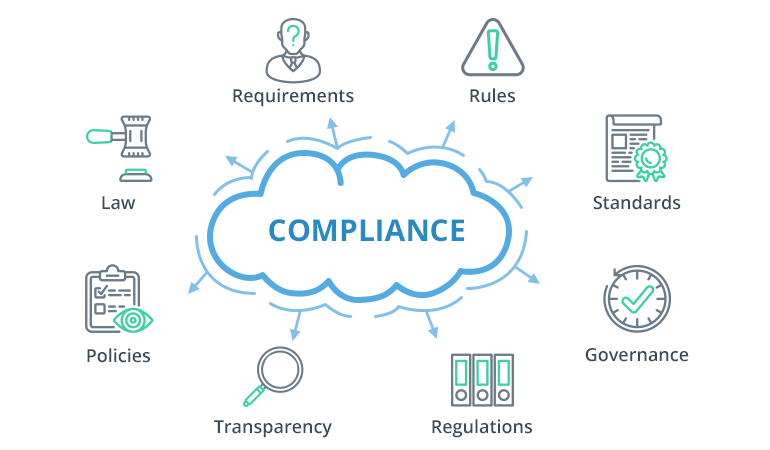

Custom Solutions: Enabling Transparency in Financial Compliance

Digital and custom platforms enhance transparency in compliance efforts within the financial services industry - enabling financial services providers in Saudi Arabia to build trust with regulators, customers, and other stakeholders through transparent practices.

Building Trust through Transparency

In Saudi Arabia's financial services sector, digital platforms are revolutionizing transparency. They empower organizations to:

- Strengthen Trust: Establish robust trust with regulators, customers, and stakeholders through clear, transparent practices.

- Facilitate Monitoring: Offer real-time insights into compliance activities, ensuring that all parties can track and verify adherence to regulations.

The Role of Technology in Compliance Transparency

These platforms harness technology to:

- Enable Real-Time Oversight: Provide a live view of compliance activities, enabling stakeholders to monitor ongoing compliance efforts effectively.

- Enhance Stakeholder Engagement: Ensure that all involved parties have a comprehensive understanding of compliance processes.

Increasing Trust Through Transparency

The transparent nature of digital platforms in financial services yields significant benefits:

- Improved Record-Keeping: Enhance documentation and record management, making vital information readily available for stakeholders.

- Strengthen Relationships: Foster better relationships between financial organizations and regulatory bodies through open and transparent practices.

- Boost Customer Confidence: Instill a sense of trust and security among customers who value transparency in their financial interactions.

Technology's Impact on Compliance Processes

AI and ML for Real-Time Monitoring

Utilizing artificial intelligence (AI) and machine learning (ML) has revolutionized the way compliance processes are handled in the finance industry.

These advanced technologies enable real-time monitoring of transactions and activities, providing a proactive approach to regulatory compliance. AI algorithms and predictive analytics enhance fraud detection capabilities, helping organizations identify potential fraudulent activities more efficiently.

Related: GenAI Reshaping the Future of Banking in Saudi Arabia

ML models play a crucial role in product discovery, identifying patterns and anomalies that may indicate non-compliance and disruption, enabling companies to take immediate action.

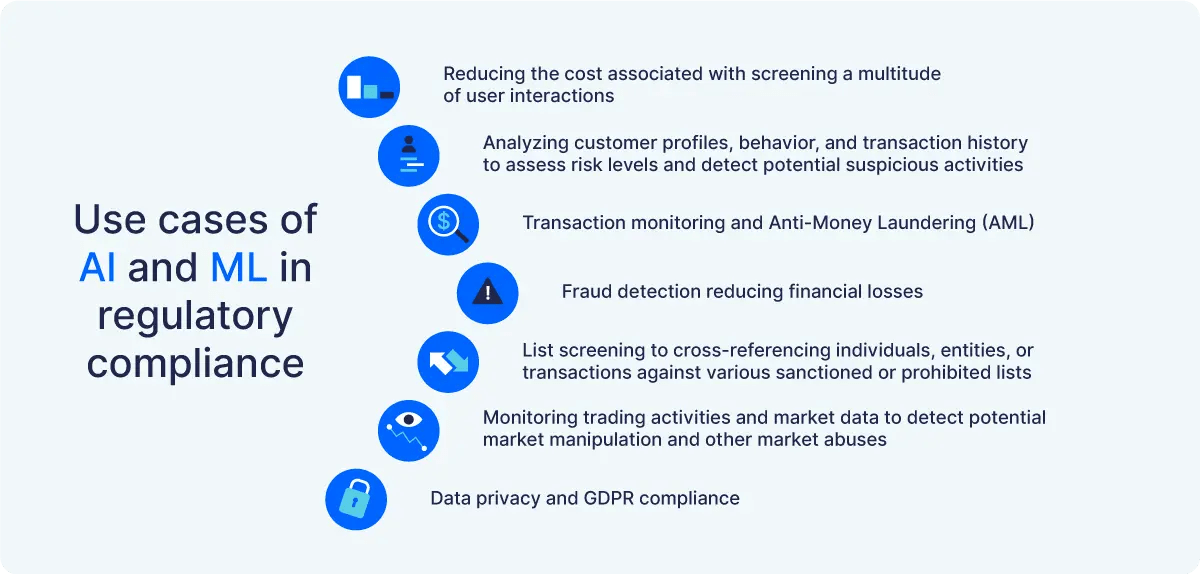

The following are the ways banks and financial service providers are utilizing AI and ML:

-

Transaction Monitoring: Utilizes ML and AI to detect suspicious activities in real-time, aiding in compliance and preventing fraud.

-

Regulatory Compliance Monitoring: ML algorithms provide real-time oversight of regulatory adherence, enabling prompt identification and correction of violations.

-

KYC Verification: AI and ML models verify customer identities in real-time, aligning with KYC regulations to prevent fraud.

-

Risk Assessment: AI and ML offer real-time risk analysis, aiding informed decision-making and compliance with risk management norms.

-

Fraud Detection: ML and AI algorithms identify transaction anomalies in real-time, protecting assets and ensuring anti-fraud regulation compliance.

-

Customer Due Diligence: AI and ML systems conduct real-time customer data analysis for regulatory compliance in identification and verification.

-

Market Surveillance: ML and AI analyze market data and trends, providing insights for compliance with market surveillance regulations.

-

Trade Monitoring: AI and ML systems monitor trading activities, detecting unfair practices to ensure compliance with fair trading regulations.

-

Compliance Reporting: ML algorithms automate compliance report generation, ensuring adherence to governmental and regulatory requirements.

Transforming Compliance with RegTech

Transforming Compliance Dynamics

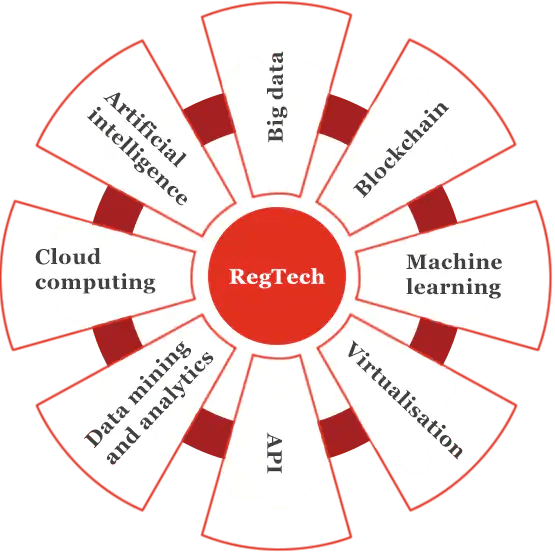

Regulatory technology (RegTech) marks a significant shift in how financial institutions handle compliance. Here's a closer look at how RegTech is redefining compliance processes:

- Automation and Efficiency: RegTech harnesses technology to automate and refine compliance tasks, boosting both efficiency and accuracy.

- Actionable Insights from Automated Analysis: These solutions transform reporting and data analysis, offering valuable insights for effective regulatory adherence.

RegTech's Adaptive Power

The true strength of RegTech lies in its agility and innovation:

- AI and ML in KYC: Utilizes AI and machine learning to enhance and streamline Know Your Customer processes.

- Blockchain for Record-Keeping: Employs blockchain technology for secure, transparent compliance records.

- Automated Risk Assessment: Analyzes extensive data sets to pinpoint potential compliance risks.

- Robotic Process Automation (RPA): Applies RPA for repetitive tasks like data entry and reporting, maximizing efficiency.

- Real-Time Monitoring: Implements surveillance systems for immediate detection and prevention of financial fraud.

- Cloud-Based Solutions: Offers cloud technology for efficient data management and analysis.

- NLP for Regulatory Analysis: Utilizes natural language processing to dissect and interpret information from legal and regulatory documents.

By integrating RegTech, financial institutions can:

- Stay ahead of regulatory changes, ensuring continual compliance with minimal manual input.

- Securely manage data while maintaining transparency in compliance processes.

- Harness the latest technologies to automate complex compliance operations, saving time and resources.

Need help building your next digital product? Our team can help your financial institution accelerate it's digital transformation. Contact us for a free consultation.

Compliance as a Service (CaaS)

Compliance as a Service (CaaS) emerges as a game-changer for financial institutions, offering a streamlined approach to mastering compliance challenges.

Here's how CaaS providers like Splunk transforms the compliance landscape:

- Specialized Expertise: CaaS providers bring tailored expertise and technology, laser-focused on meeting specific compliance requirements.

- Simplified Processes: It streamlines and simplifies compliance workflows, making regulatory management more efficient.

- Expert Guidance: Financial institutions gain access to seasoned professionals offering advice and insights on intricate compliance matters.

- Adapting to Change: CaaS ensures agility in keeping up with evolving regulations and industry benchmarks.

- Cost Efficiency: Reduces financial burdens by optimizing the expense linked to compliance-related tasks.

- Risk Mitigation: Proactively identifies and addresses potential compliance risks, fortifying risk management strategies.

- Scalable Solutions: Offers adaptable solutions, catering to the unique needs of diverse financial entities.

- Real-Time Oversight: Provides dynamic monitoring and reporting tools for vigilant compliance tracking.

- Data Security: Bolsters data protection and privacy, a critical aspect for financial institutions.

- Reputation Management: Aids in maintaining and enhancing trust among clients and stakeholders.

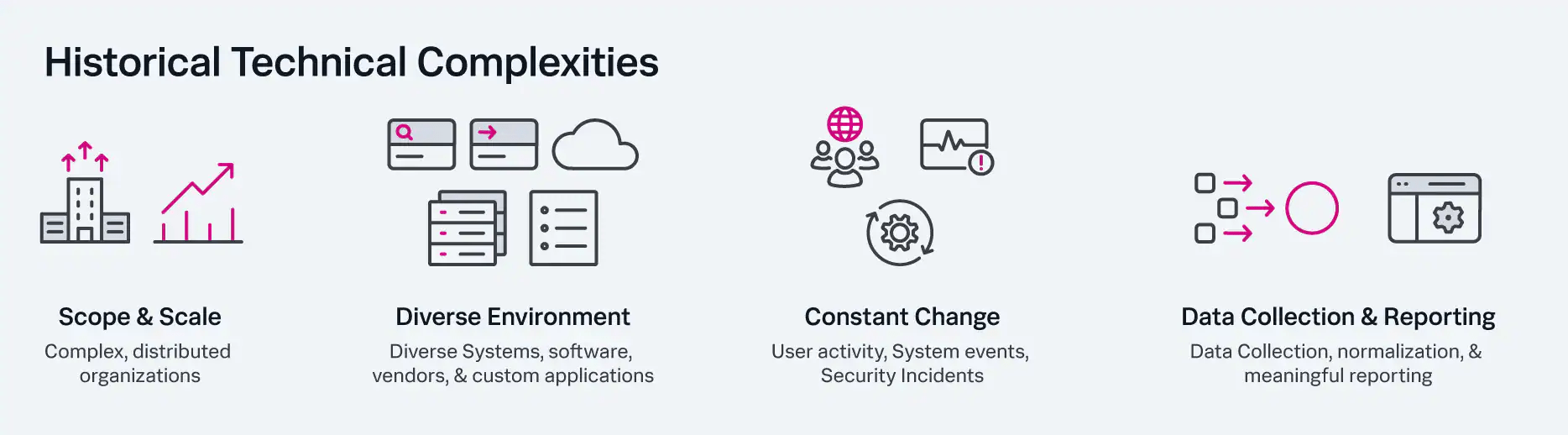

Outsourcing to CaaS providers not only cuts down on the costs of an in-house compliance team but also ushers in state-of-the-art technological solutions that handle historical technical complexities.

Consider these benefits:

- Resource Optimization: By automating compliance processes, CaaS frees up valuable resources, allowing for their reallocation to core business functions.

- Enhanced Efficiency: Streamlines compliance operations, thereby boosting overall organizational efficiency.

Navigating AML and KYC Requirements

Digital Strategies for AML/KYC

Implementing digital strategies for Anti-Money Laundering (AML) and Know Your Customer (KYC) processes is crucial in today's financial landscape.

The integration of advanced digital strategies in AML and KYC processes represents a transformative step for Saudi Arabia's banking sector. It's a move towards more efficient, secure, and compliant financial operations, where technology not only meets regulatory requirements but also elevates the customer experience.

These strategies leverage technology to streamline due diligence and risk assessment procedures, ensuring regulatory compliance.

Here's how you benefit:

- Streamlining Compliance: Technology-driven strategies significantly enhance due diligence and risk assessments, aligning with regulatory norms.

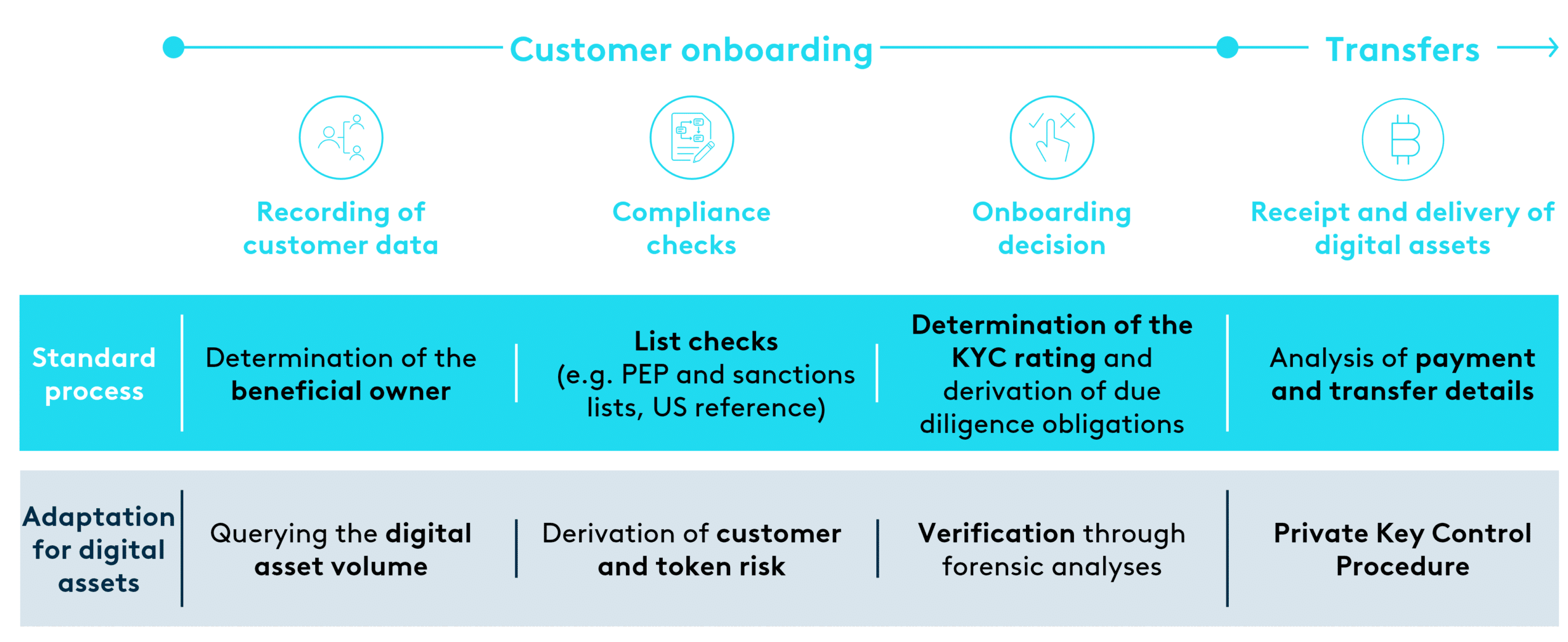

- Impact on Design and Development: When crafting your digital tools, integrating customer experience features including customer onboarding and AML/KYC processes from the outset is vital. This approach ensures that your products meet both functional and user experience needs.

Defining your strategies will inform your design and development efforts to ensure your products and tools incorporate needed customer experience features from the beginning.

Transforming Customer Onboarding and Compliance Processes

Custom digital platforms are at the forefront of transforming the Saudi banking sector:

- Enhancing Customer Onboarding: Incorporated within these custom solutions and tools are the ability to automate checks and efficiently verify the identities of their customers using their online banking platforms and apps.

- Innovative Banking Solutions: By embracing the latest trends in mobile development, Saudi banks offer cutting-edge digital financial experiences.

- Automated Identity Verification: Custom tools within these platforms enable efficient customer identity checks through online banking and apps, essential for streamlined operations and heightened security.

Advanced Technologies for Efficient Data Analysis

By leveraging advanced algorithms and machine learning capabilities, these platforms can analyze vast amounts of data quickly, flagging any suspicious activities or potential risks. The power of modern algorithms and machine learning in these platforms offers unparalleled advantages:

- Rapid Data Analysis: They swiftly analyze extensive data, promptly flagging suspicious activities or risks.

- Improved Accuracy and Reliability: Automated systems surpass manual methods in precision, significantly reducing errors.

- Adherence to Regulatory Standards: This technological leverage ensures compliance with stringent regulations, minimizing operational risks.

Choosing the ideal custom software development agency as your digital transformation partner will enhance your ability to launch your financial experiences in alignment with all regulations and enhance the accuracy and relability of AML/KYC checks.

The Role of CaaS in Data Security

Compliance as a Service (CaaS) providers prioritize data security. These reliable hosting providers implement robust measures to ensure the secure storage, transmission, and processing of sensitive financial data.

Encryption is a key component in safeguarding data during transit or storage.

By encrypting data using strong cryptographic algorithms, CaaS providers ensure that even if there is unauthorized access to the information, it remains unreadable and unusable.

Access controls are another crucial aspect of data security. CaaS providers implement stringent access control mechanisms that restrict who can view or modify sensitive financial data.

This helps prevent unauthorized individuals from gaining access to confidential information.

CaaS providers employ other security measures such as firewalls, intrusion detection systems, and regular vulnerability assessments to protect against potential data breaches.

These proactive measures help identify any vulnerabilities in the system promptly so that they can be addressed before they are exploited by malicious actors.

Building Relationships for Future Compliance Success

Building strong relationships with regulators, industry peers, and customers is essential for long-term compliance success. Collaboration with stakeholders, including certified expert developers in Saudi Arabia, helps navigate complex regulatory landscapes more effectively throughout your continuous product management and delivery.

Related: Neobank Development - A Guide to Fintech Innovation

Financial institutions must establish open lines of communication with regulators to stay updated on the latest compliance requirements. By actively engaging in dialogue and seeking guidance when needed, institutions can ensure they are meeting all necessary obligations.

- Stay updated with SAMA regulations: Saudi Arabia has its own set of financial regulations, so it is crucial to stay informed about the latest updates and changes in the regulatory framework. Regularly review and understand the guidelines issued by the Saudi Arabian Monetary Authority (SAMA) to ensure compliance.

- Engage with regulators and industry associations: Actively participate in industry forums, conferences, and workshops to stay connected with regulatory updates and best practices.

- Proactive collaboration: Collaboration with industry peers is also beneficial for product discovery, as it allows for knowledge sharing and best practices exchange. Financial institutions can learn from each other's experiences and gain insights into effective compliance strategies.

Moreover, fostering trust and cooperation with customers is crucial. By prioritizing transparency and providing clear explanations about AML/KYC processes in the context of open banking, financial institutions can build trust with their customers.

Data Privacy and Consumer Protection Evolution

The Evolving Landscape of Regulations

Understanding the dynamic nature of regulatory frameworks in the finance industry is crucial for financial institutions. Regulations governing data privacy and consumer protection are constantly evolving to keep up with technological advancements and emerging risks.

As a result, it is essential for organizations to adapt their compliance strategies to stay in line with these changing regulations.

Be prepared for 2024: Top 10 Technology Trends Impacting Saudi Arabia

Adapting compliance strategies involves staying informed about regulatory changes and updates. This can be a challenging task, considering the sheer volume of information that needs ongoing support and maintenance to be monitored.

However, leveraging robust custom digital banking and fintech-driven platforms can help financial institutions stay on top of these changes more effectively. These platforms provide real-time notifications and updates regarding regulatory developments, ensuring that organizations have access to accurate and timely information.

Digital Euro and Open Finance Challenges

The introduction of digital currencies like the Digital Euro poses unique challenges for regulators and financial institutions alike. With the rise of open finance initiatives and decentralized financial systems, there are concerns related to regulatory oversight and consumer protection.

Addressing these concerns requires a comprehensive understanding of the regulatory landscape surrounding digital currencies.

Financial institutions need to ensure compliance with emerging regulations in the digital finance space while navigating potential risks associated with customer data privacy, security breaches, and fraud.

To meet these challenges head-on, financial institutions can leverage robust digital platforms that offer advanced data protection measures.

Drupal 10 powered custom solutions enable organizations to securely manage customer data while adhering to strict privacy regulations.

By implementing robust data protection measures, such as encryption protocols and secure data storage practices, financial institutions can safeguard sensitive customer information from unauthorized access or breaches.

Virtual Assets' Regulatory Framework

Virtual assets, including cryptocurrencies like Bitcoin or Ethereum, operate within a distinct regulatory framework that continues to evolve rapidly. It is essential for financial institutions dealing with virtual assets to understand this framework thoroughly.

Compliance considerations include implementing effective Know Your Customer (KYC) procedures when dealing with virtual asset transactions. Financial institutions must also monitor and report these transactions in accordance with regulatory requirements.

Digital platforms equipped with advanced data analytics capabilities can assist in monitoring virtual asset transactions, ensuring compliance while mitigating the risks associated with illicit activities.

Embracing Digital Transformation in Compliance

Fostering a Culture of Compliance Digitally

To navigate regulatory compliance in finance effectively, financial institutions must embrace digital tools and training programs that promote a culture of compliance. By leveraging technology, these institutions can encourage employee accountability and adherence to regulatory requirements.

Digital platforms provide an avenue for facilitating compliance awareness and education initiatives, ensuring that employees are equipped with the necessary knowledge to meet regulatory standards.

Remaining Agile in Changing Regulations

In today's fast-paced regulatory landscape, agility is crucial for financial institutions. The Saudi banking sector is experiencing a revolution, and is transforming at an accelerated pace.

Adapting quickly to changing regulations is essential to avoid penalties and maintain compliance. Digital platforms play a key role in enabling organizations to implement necessary compliance changes promptly. By utilizing these platforms, financial institutions can build flexibility into their compliance processes, allowing them to adapt smoothly as regulations evolve.

Flexibility and Security in Digital Compliance Management

In the ever-evolving world of financial sector compliance, digital platforms are increasingly vital. These solutions are key in adapting to dynamic regulatory landscapes, highlighted by several significant developments:

-

AML Law Adaptation: Emphasizing the importance of adapting to AML Law reforms, digital platforms enhance AML and KYC processes through strengthened financial intelligence and modernized systems.

-

Data Collection Regulations: As data collection laws evolve, custom platforms like Drupal 10 enable rapid adaptation, ensuring compliance and effective data management.

-

Fintech Partnerships: The rise of fintech collaborations brings both opportunities and regulatory challenges. Digital platforms provide essential tools for risk assessment and management in this changing landscape.

-

Cryptocurrency Dynamics: With the growth of cryptocurrency, these platforms address new risks and money laundering activities through advanced analytics and transaction monitoring.

-

ESG Integration: The focus on Environmental, Social, and Governance (ESG) factors necessitates agile compliance solutions that can incorporate these emerging considerations.

-

Cryptocurrency Regulation Readiness: Adapting to the regulatory shifts in digital assets is crucial. Financial institutions benefit from flexible, digital compliance solutions to manage the unique risks of cryptocurrency transactions.

Drupal 10 Powered Platforms

Drupal 10 stands out in this landscape, offering financial institutions the strategic benefits of agility, security, and scalability. It's not just about ensuring compliance; it's about enhancing operational efficiency, managing risks, and staying adaptable to new trends and technologies.

Features like encryption protocols and access controls protect sensitive information, fortifying defenses against cyber threats. In sum, these platforms represent a comprehensive approach to managing compliance, efficiency, and security in today's financial sector.

Furthermore, Drupal 10 enhances proactive compliance monitoring and data analytics. Its advanced tools allow for efficient data analysis and risk identification, ensuring timely interventions and issue resolution.

Compliance in Payment Processing and Virtual Assets

Ensuring Compliant Transactions

By leveraging tailored digital platforms, financial institutions can automate transaction monitoring processes, allowing them to detect suspicious activities in real-time.

For example, this helps to prevent fraudulent transactions and ensures that all transactions in digital banking in Saudi Arabia comply with relevant regulations.

Robust systems implemented on digital platforms enable the verification of customer identities, further reducing the risk of fraud.

Continuous improvement is essential though... conducting a thorough UX review ensures a seamless and user-friendly experience for customers.

Navigating the Regulatory Landscape of Payments

The regulatory landscape surrounding payment processing and money transfers can be complex. Saudi banks and financial institutions must navigate various anti-money laundering (AML) regulations and payment service directives (PSD) in the Saudi finance industry.

Digital platforms provide valuable tools for streamlining customer onboarding and payment compliance processes by automating tasks such as identity verification and transaction monitoring.

By understanding these regulations and adhering to them, businesses can ensure compliance while mitigating risks.

Virtual Asset Opportunities and Risks

Virtual assets, such as blockchain technology and tokenization, present unique opportunities for financial institutions. However, they also come with their own set of risks that need to be addressed. Fraud, money laundering, and market manipulation are some of the risks associated with virtual assets.

To mitigate these risks, financial institutions can utilize digital platforms that provide secure trading environments for virtual assets - often incorporating advanced security measures such as multi-factor authentication and encryption techniques.

Related: Creating a Secure Online Banking Platform

Preparing for Audits and Regulatory Demands

Meeting Auditor Expectations with Digital Tools

In the realm of financial compliance, digital tools are reshaping auditing. Automation in data collection and analysis simplifies the audit process, enhancing efficiency and accuracy. This allows auditors to access compliance records in real-time, significantly reducing manual verification efforts.

Consider these essential digital solutions:

- Automated Data Analysis: Quickly uncovers patterns and irregularities in financial data.

- Electronic Document Management: Organizes and provides easy access to audit-related documents.

- Risk Assessment Software: Identifies and prioritizes potential institutional risks.

- Real-Time Collaboration Platforms: Facilitates seamless communication among audit teams.

- Data Visualization Tools: Transforms complex financial data into understandable formats.

- Electronic Workpapers: Streamlines documentation and tracking of audit activities.

- Audit Management Software: Enhances the audit workflow and ensures regulatory compliance.

- Data Security Tools: Safeguards sensitive financial data against unauthorized access and breaches.

By integrating these tools, financial institutions can not only meet but exceed auditor expectations, ensuring a more efficient, secure, and streamlined compliant audit process.

Navigating Best Practices in Regulatory Compliance for Finance

Achieving and maintaining regulatory compliance in finance is a multi-faceted endeavor. Here’s a streamlined approach to best practices:

-

Continuous Risk Assessment: Regularly evaluate potential risks and compliance gaps. Stay proactive in adapting to regulatory changes.

-

Establishing Strong Internal Controls: Develop clear internal policies and procedures to guide employee actions and ensure regulatory adherence.

Key Strategies to Consider:

- Stay Informed: Keep abreast of the latest regulatory requirements specific to Saudi Arabia’s finance industry.

- Develop Compliance Framework: Craft and enforce comprehensive compliance policies and procedures.

- Risk Management: Regularly conduct risk assessments to spot potential compliance issues.

- Cultivate Compliance Culture: Foster an organizational ethos that prioritizes regulatory compliance.

- Employee Training: Offer extensive training programs on regulatory compliance matters.

- Monitoring and Reporting: Implement robust systems for tracking and reporting compliance activities.

- Documentation Management: Keep meticulous records of all compliance-related efforts.

- Internal Audits: Periodically assess internal compliance adherence through audits.

- Regulatory Relationships: Maintain active communication with regulatory bodies and participate in industry associations.

- Continuous Improvement: Regularly review and enhance your compliance processes and controls.

Cloud Computing's Role in Streamlining Financial Compliance

Cloud computing has established a vital relationship with Compliance as a Service (CaaS). This collaboration is integral for organizations looking to effectively manage their compliance requirements, especially in platform engineering and digital experience design.

Key Aspects of Cloud Computing in Compliance:

- AML and KYC Compliance: Cloud solutions automate and refine data analysis, essential for Anti-Money Laundering and Know Your Customer processes.

- Audit Efficiency: Streamlines audit documentation, providing secure and centralized access for auditors.

- Risk Management: Enhances risk assessment through advanced analytics.

In Saudi Arabia's financial sector, cloud computing is pivotal in adapting to unique compliance needs. The shift towards digital banking has accelerated the adoption of cloud-based services, offering necessary scalability and security.

The use cases of Cloud computing in compliance are evolving:

- Artificial Intelligence (AI) and Machine Learning (ML): These technologies are increasingly being integrated to analyze vast data volumes, detect compliance issues, and adapt to regulatory changes.

- Blockchain Technology: Offers a decentralized and secure way to record transactions, enhancing compliance transparency and auditability.

- Adopting Cloud for Scalable Compliance: Financial institutions are increasingly embracing cloud computing for cost-effective, scalable compliance solutions, meeting the demands of stringent regulatory environments.

- AI Integration in Compliance: AI tools are revolutionizing compliance by automating tasks such as transaction monitoring and data analysis for regulatory reporting, streamlining processes significantly.

- Advancing Data Security: With data breaches on the rise, cloud providers are intensifying security measures, including advanced encryption and real-time threat detection, to protect sensitive financial data.

- Customized Compliance Services (CaaS): Specialized CaaS offerings by cloud providers are becoming more prevalent, tailored to meet the unique compliance needs of financial institutions.

- Blockchain for Auditing: Utilizing blockchain's transparent and immutable properties enhances the accountability and accuracy of compliance records.

- Real-time Monitoring and Reporting: Cloud computing facilitates continuous monitoring and immediate reporting, critical for maintaining ongoing compliance.

- Collaborative Cloud Platforms: Cloud-based tools enhance communication among compliance stakeholders, including officers, auditors, and regulators.

- Automation via RPA: Robotic Process Automation is being employed to automate routine compliance tasks, freeing up resources for more complex issues.

- Disaster Recovery Solutions: Cloud-based disaster recovery ensures the resilience and availability of compliance systems, vital for business continuity.

- Predictive Compliance with Machine Learning: Machine learning algorithms are being used to analyze compliance data, predicting potential compliance risks and trends.

Conclusion

These platforms have emerged as invaluable tools for financial institutions, helping them stay ahead of evolving regulatory requirements and streamline their compliance processes. By leveraging technology, organizations can enhance their efficiency, accuracy, and transparency in meeting anti-money laundering (AML) and know your customer (KYC) requirements, as well as adapting to the ever-evolving landscape of data privacy and consumer protection.

The benefits of embracing digital transformation in compliance extend beyond operational improvements. They contribute to building trust with customers and regulators alike. As financial institutions continue to face audits and regulatory demands, digital platforms empower them to prepare more effectively, ensuring they are well-equipped to demonstrate compliance and address any potential issues that may arise.

To thrive in today's regulatory environment, it is imperative for financial institutions to recognize the transformative power of digital platforms in navigating compliance challenges. By embracing innovation in software development and web development, organizations can position themselves as leaders in the field of Drupal 10 while safeguarding their operations and maintaining the trust of their stakeholders.

By staying informed about emerging trends and best practices in customer experience, organizations can further enhance their success.

Frequently Asked Questions

What is the importance of regulatory compliance in finance?

Regulatory compliance is crucial in finance to ensure adherence to laws and regulations governing the industry. It helps maintain transparency, protect consumers, prevent fraud, and promote stability in financial systems.

How can digital platforms assist with navigating regulatory compliance in the financial services industry?

Digital platforms provide tools and technologies that streamline compliance processes, automate data collection and analysis, enable real-time monitoring, and facilitate reporting. They help organizations stay up-to-date with changing regulations and efficiently manage compliance requirements.

How does technology impact compliance processes?

Technology revolutionizes compliance by enhancing efficiency, accuracy, and speed. Automation reduces manual errors, advanced analytics identify risks more effectively, AI-powered systems improve fraud detection capabilities, while blockchain ensures secure data sharing. Technology transforms how organizations approach regulatory compliance.

What are AML and KYC requirements in finance?

AML (Anti-Money Laundering) and KYC (Know Your Customer) are crucial components of regulatory compliance in Saudi financial institutions. AML measures aim to prevent money laundering activities, while KYC procedures verify customer identities to mitigate risks related to money laundering, terrorist financing, or other illicit activities.

How can organizations prepare for audits and regulatory demands?

Organizations should maintain comprehensive documentation of their compliance efforts including policies, procedures, risk assessments, training records etc. Regular internal audits should be conducted to identify gaps or weaknesses. Collaboration with legal experts can also help ensure preparedness for audits and regulatory demands.