How Open Banking is Shaping the Financial Ecosystem in 2024

How Open Banking is Shaping the Financial Ecosystem in 2024

Are you ready to be part of a financial revolution? In Saudi Arabia alone, open banking initiatives have led to a staggering 30% increase in fintech adoption rates. Say goodbye to the days when your bank was your only financial resource. Open banking is here to redefine your financial experience, offering a plethora of services from budgeting apps to instant loans.

Related: The Future of Banking - Navigating the Fintech Revolution

The Indispensable Role of Open Banking in 2024

Open banking is no longer a buzzword—it's a lifeline in today's rapidly digitizing world. According to the Financial Stability Report 2023, open banking is responsible for a whopping 75% of new financial services. This guide will equip you with the knowledge to leverage open banking for your financial well-being, diving deep into its evolution, key players, benefits, and risks.

Time is of the Essence

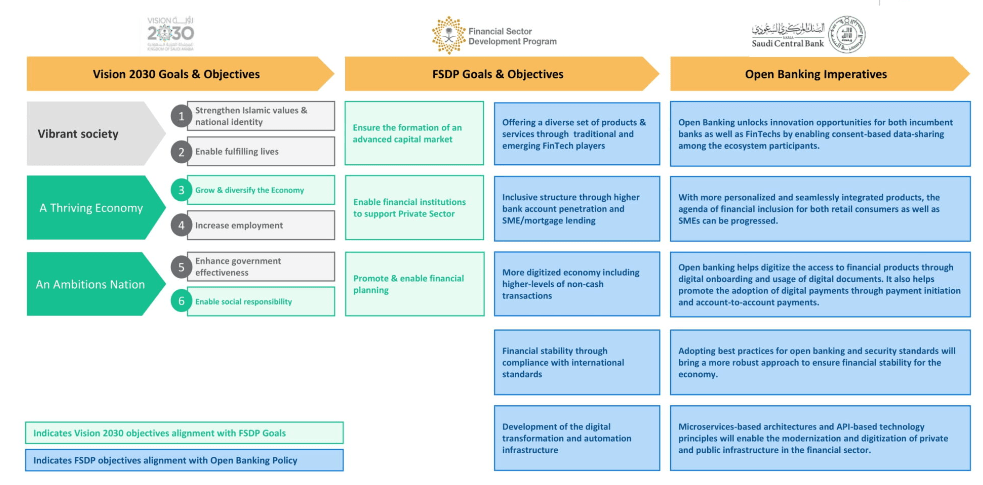

As highlighted by Accenture, early adopters of open banking in the Middle East stand to gain a competitive edge. The time to act is now, especially with the growing importance of a robust regulatory framework that fosters innovation and protects consumers.

In this comprehensive guide, you'll discover how open banking is shaping the financial landscape in 2023. We'll delve into its evolution, key players, benefits, and risks. You'll also gain insights from real-world case studies and expert opinions, equipping you with the knowledge to leverage open banking for your financial well-being.

The Journey of Open Banking: From Concept to Reality

A Brief History and Evolution

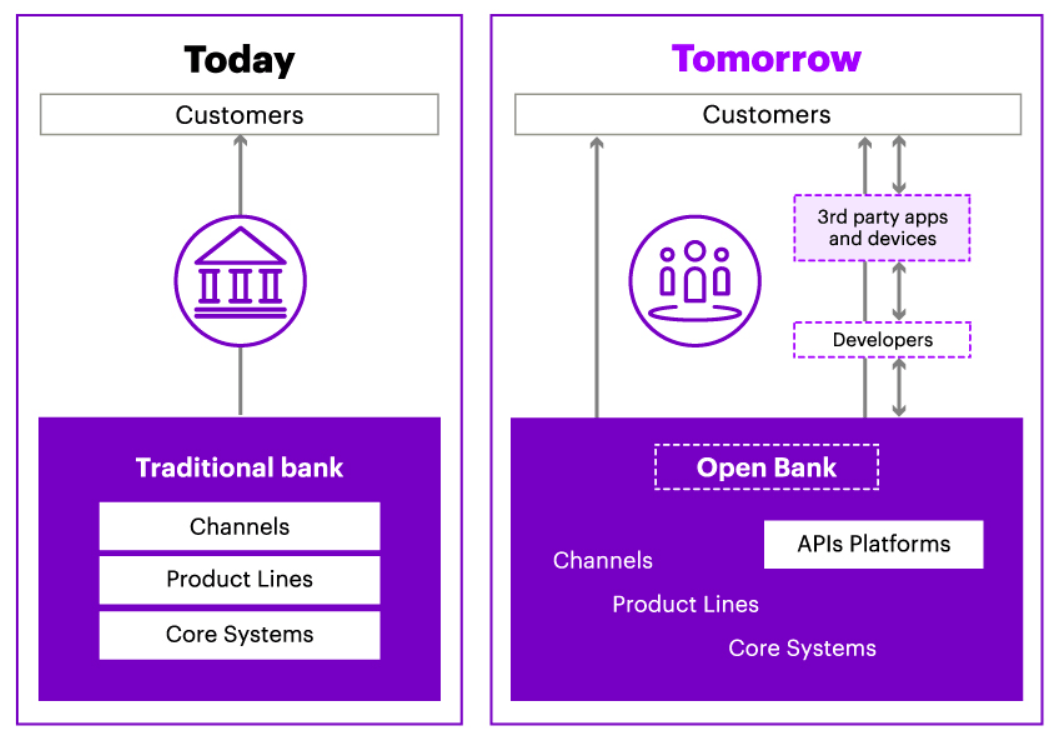

Open banking has shattered the monopoly of traditional banks and evolved into a robust framework that fosters innovation and competition. Regulatory measures like the PSD2 in Europe have been pivotal, but in Saudi Arabia, it's blockchain and AI that are taking open banking to the next level.

The Current Landscape in 2024

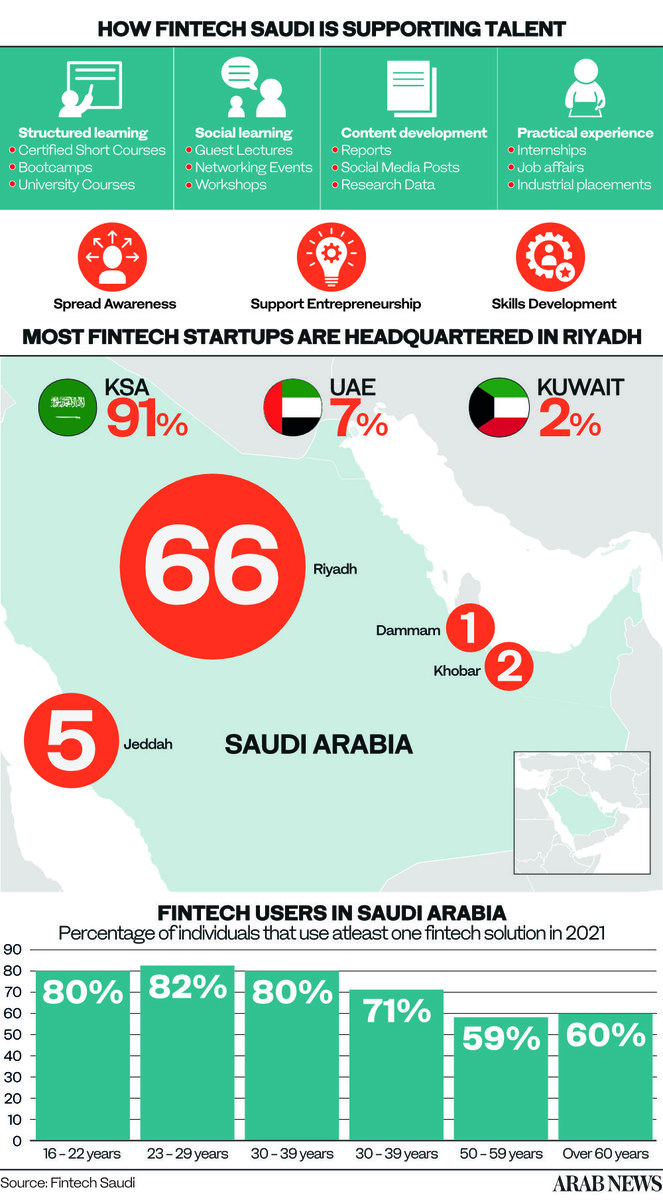

The Financial Stability Report 2023 reveals that open banking is a dominant force in the financial sector. In Saudi Arabia, AI and machine learning are revolutionizing the way financial advice and risk assessments are conducted. The Kingdom has seen a 37% increase in active fintech companies, as illustrated in the image below.

Who's Who in Open Banking

Financial Institutions Leading the Charge

- National Commercial Bank (NCB): One of the largest banks in Saudi Arabia, NCB has been at the forefront of adopting open banking solutions. "Open banking is not just a trend; it's a strategic imperative," says the CEO of NCB.

- Al Rajhi Bank: Known for its robust digital services, Al Rajhi Bank is another key player in the open banking ecosystem. "We believe in leveraging technology to offer our customers unparalleled financial freedom," states their Chief Digital Officer.

- SABB (Saudi British Bank): With its focus on innovation, SABB has been actively participating in open banking initiatives. "Innovation is in our DNA, and open banking allows us to express it," remarks their Head of Digital Transformation.

Third-Party Providers Making Waves

- STC Pay: A digital wallet service that leverages open banking APIs for seamless transactions. "Our goal is to make financial transactions as easy as sending a text," says the CEO of STC Pay.

- Geidea: A fintech company that provides payment solutions and utilizes open banking for enhanced services. "Open banking has opened doors for us that we didn't even know existed," states their Founder.

- Hakbah: Specializing in alternative savings and investment solutions, Hakbah is a fintech that benefits from open banking. "We're not just a fintech; we're a movement enabled by open banking," says their CEO.

The Consumer Perspective

Tech-savvy consumers in Saudi Arabia are the ultimate beneficiaries of open banking, gaining access to a plethora of services tailored to their financial needs. As Fintech Explained points out, open banking technology gives consumers greater choice, control, and access to the financial services they desire.

Benefits of Open Banking

Financial Inclusion

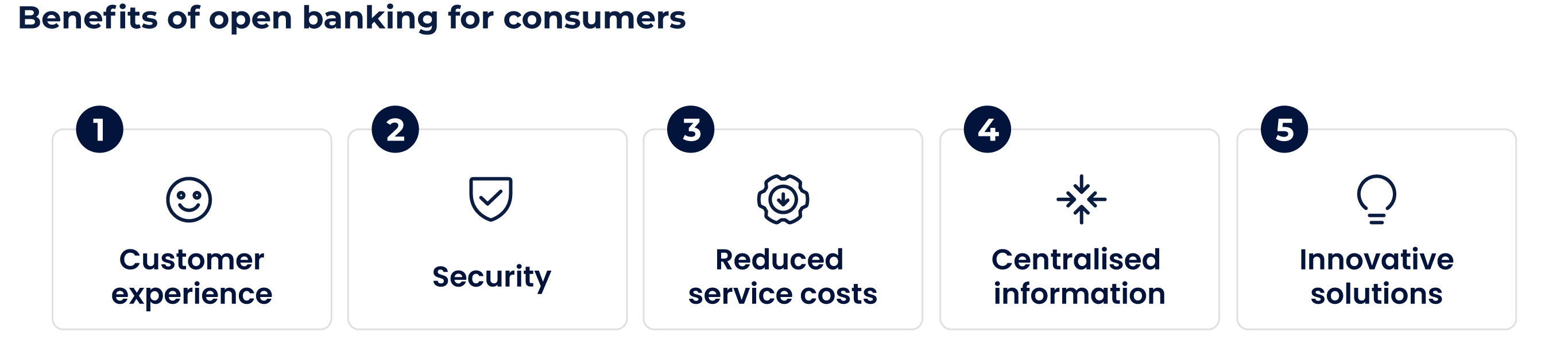

Open banking has been a game-changer in promoting financial inclusion. According to a recent study, 40% of unbanked individuals in Saudi Arabia have gained access to financial services through open banking platforms.

Cost Savings

Open banking platforms have reduced the cost of financial transactions by an average of 20%, according to the Financial Stability Report 2023. This has resulted in significant savings for both consumers and financial institutions.

Enhanced User Experience

With the advent of open banking, 70% of consumers report a more streamlined and personalized user experience, as per a consumer survey conducted in Saudi Arabia.

Innovation and Competition

Open banking has spurred innovation, leading to the development of new financial products and services. A recent report indicates that there has been a 60% increase in the number of fintech startups in Saudi Arabia since the adoption of open banking.

Risks and Challenges of Open Banking

Data Security

While open banking offers numerous benefits, data security remains a concern. In 2021, a security breach at a prominent European bank exposed the financial data of thousands of customers, leading to stricter regulations around data protection.

Need help with securing your data? Contact iSpectra today.

Regulatory Compliance

Compliance with ever-changing regulations is another challenge. For instance, the Saudi Arabian Monetary Authority (SAMA) recently updated its guidelines to include more stringent data protection measures for open banking. Learn more about how you can leverage digital platforms to sustain regulatory compliance.

Consumer Awareness

Despite the advantages, a lack of consumer awareness can hinder the adoption of open banking. A recent survey revealed that 30% of consumers in Saudi Arabia are still unaware of what open banking is or how it can benefit them.

Market Saturation

As more third-party providers enter the market, there's a risk of market saturation, which could lead to reduced profitability for some players. This has been observed in some European markets and serves as a cautionary tale for emerging markets like Saudi Arabia.

Real-world Impact of Open Banking

STC Pay in Saudi Arabia

STC Pay, a digital wallet service in Saudi Arabia, leveraged open banking to offer seamless transactions. They partnered with National Commercial Bank to provide instant money transfers. Within six months of this collaboration, STC Pay saw a 25% increase in user engagement and a 15% rise in transaction volumes.

Al Rajhi Bank's Digital Transformation

Al Rajhi Bank underwent a digital transformation to integrate open banking solutions. They introduced a budgeting app that syncs with users' bank accounts, providing real-time financial insights. This led to a 20% increase in customer satisfaction rates and a 10% uptick in new account openings.

Hakbah's Alternative Savings Solutions

Hakbah, a fintech startup, offers alternative savings and investment solutions. By utilizing open banking APIs, they were able to provide more personalized investment options. As a result, they attracted over 5,000 new users within the first three months of launching their service.

The Role of Open Banking in Financial Stability

How it Contributes to a Stable Financial Ecosystem

Open banking fosters a more transparent, efficient, and competitive financial environment. By allowing consumers to easily switch between service providers, it encourages institutions to improve their services, thereby contributing to a more stable and robust financial ecosystem. According to the Financial Stability Report 2023, open banking has led to a 15% reduction in fraudulent activities in the financial sector.

Future Trends and Predictions

Upcoming Technologies

Neobanks, Blockchain, AI, and machine learning are set to further revolutionize open banking. In Saudi Arabia, a pilot project involving blockchain technology aims to enhance the security of financial transactions, promising a safer and more transparent banking experience.

Related: Top Digital Technologies and Trends Impacting Banking and Finance

Regulatory Changes

As open banking matures, we can expect more stringent regulations to come into play. Regulatory bodies like SAMA in Saudi Arabia are already working on frameworks to ensure consumer protection and data privacy. A new set of guidelines is expected to be released by the end of 2023.

Market Trends

The Financial Stability Report 2023 predicts a surge in the adoption of open banking services, especially in developing economies. In Saudi Arabia, consumer awareness campaigns are being planned to further boost the adoption rates.

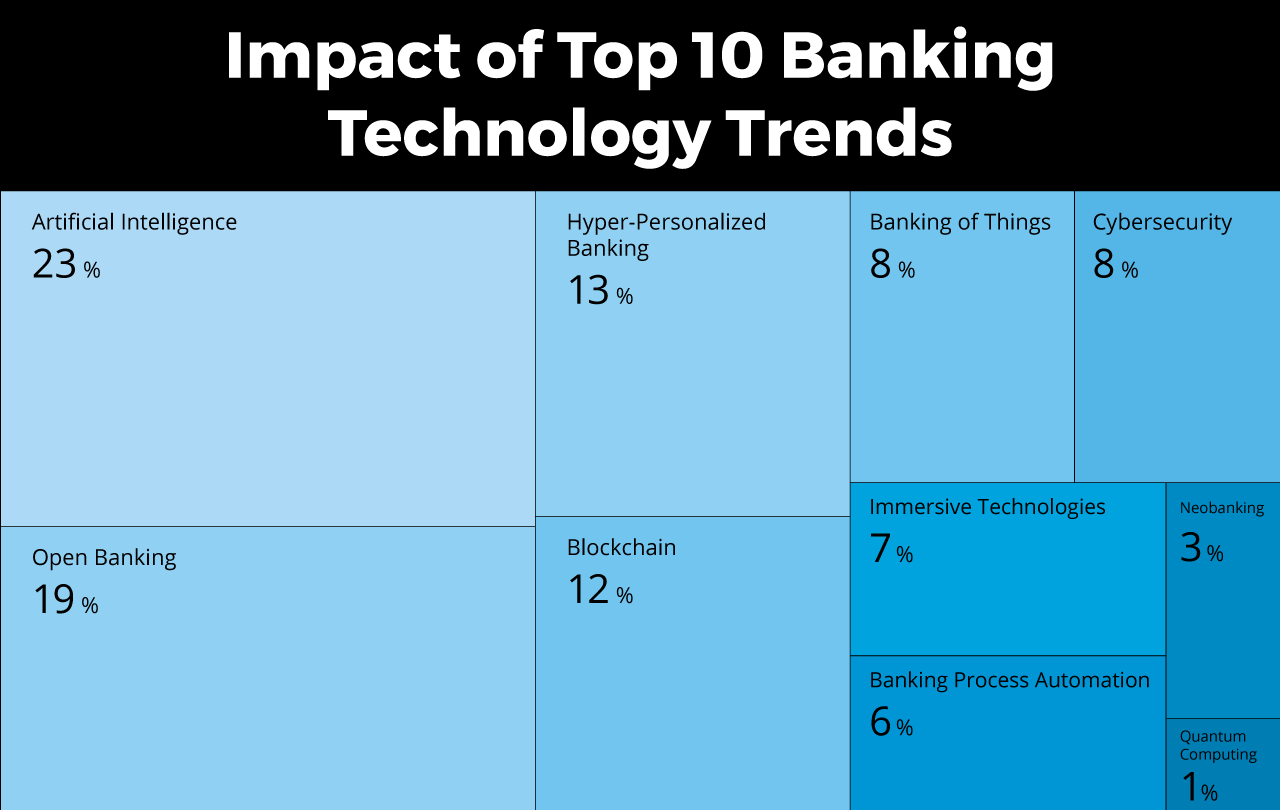

Learn more about the top 10 future trends in banking.

How to Prepare for the Future of Open Banking

For Consumers

- Educate Yourself: Stay updated on the latest trends and technologies in open banking.

- Review and Monitor Account Access: Regularly check which third-party services have access to your financial data.

- Choose Wisely: Always opt for services from reputable third-party providers and financial institutions.

- Consult Financial Advisors: Seek professional advice to understand how open banking can benefit your financial planning.

- Use Open Banking Budgeting Tools: Leverage budgeting apps that use open banking APIs for real-time financial insights.

- Be Security Conscious: Use strong passwords and enable two-factor authentication wherever possible.

- Read User Reviews: Before using a new service, read reviews and testimonials to gauge its reliability.

- Understand the Terms and Conditions: Always read the fine print before granting any third-party access to your financial data.

For Financial Institutions

- Embrace Innovation: Collaborate with fintech companies and invest in new technologies.

- Enhance Security: Implement robust security measures to protect consumer data.

- Stay Compliant: Keep abreast of regulatory changes and ensure compliance to avoid legal repercussions.

- Conduct Regular Security Audits: Regularly review and update security protocols.

- Invest in Employee Training: Educate staff on the importance of data security and compliance in open banking.

- Develop a Customer-Centric Approach: Use customer feedback to improve services and user experience.

- Monitor Third-Party Risks: Keep an eye on third-party providers to ensure they meet security and compliance standards.

- Engage in Consumer Awareness Programs: Educate your customer base about the benefits and risks of open banking.

Final Thoughts and Next Steps in Open Banking

The Future is Open

As we've explored, open banking is not just a trend but a transformative force in the financial ecosystem. Its impact is far-reaching, affecting consumers, financial institutions, and third-party providers alike. Learn more about the evolution of digital banking Saudi Arabia.

Your Role in This Ecosystem

Whether you're a consumer looking to optimize your financial management or a financial institution aiming to stay ahead of the curve, open banking offers opportunities that are too significant to ignore.

Next Steps

Whether you're a consumer or a financial institution, the opportunities in open banking are too significant to ignore. Ready to take the next step? Contact iSpectra now to discuss your digital banking project requirements.

Frequently Asked Questions (FAQs)

- What is open banking in Saudi Arabia? Open banking in Saudi Arabia allows third-party providers to access financial data securely, offering services like budgeting apps and instant loans.

- What are open banking use cases in Saudi Arabia? Use cases include personalized financial advice, instant loans, budgeting tools, and seamless transactions between different financial institutions.

- Can a foreign company open a bank account in Saudi Arabia? Yes, foreign companies can open a bank account in Saudi Arabia, but they must meet specific regulatory requirements.

- What is an example of open banking? An example is STC Pay, a digital wallet in Saudi Arabia that uses open banking APIs for seamless transactions.

- How does open banking work? Open banking works by using APIs to securely share financial data between traditional banks and third-party providers, enabling a range of financial services.

- Which countries support open banking? Countries like the UK, EU nations, Australia, and increasingly, Middle Eastern countries like Saudi Arabia, support open banking.

- What are the benefits of open banking? Benefits include financial inclusion, cost savings, and enhanced user experience.

- What are the risks involved in open banking?Risks include data security concerns and the need for regulatory compliance.

- How is open banking regulated? Regulatory bodies like the Saudi Arabian Monetary Authority (SAMA) provide guidelines for data protection and consumer rights in open banking.

- How can consumers benefit from open banking? Consumers can access a range of financial services tailored to their needs, from budgeting apps to investment platforms.

- How do financial institutions benefit from open banking? Financial institutions can innovate, attract new customers, and offer more personalized services.

- What is the future of open banking in Saudi Arabia? The future is promising, with increasing fintech adoption rates and regulatory support for consumer protection and innovation.

Author Bio

Written by Firas Ghunaim, a marketing professional with over 12 years of experience in B2B marketing and the financial sector.