FinTech Revolution: Guide to Banking's Future

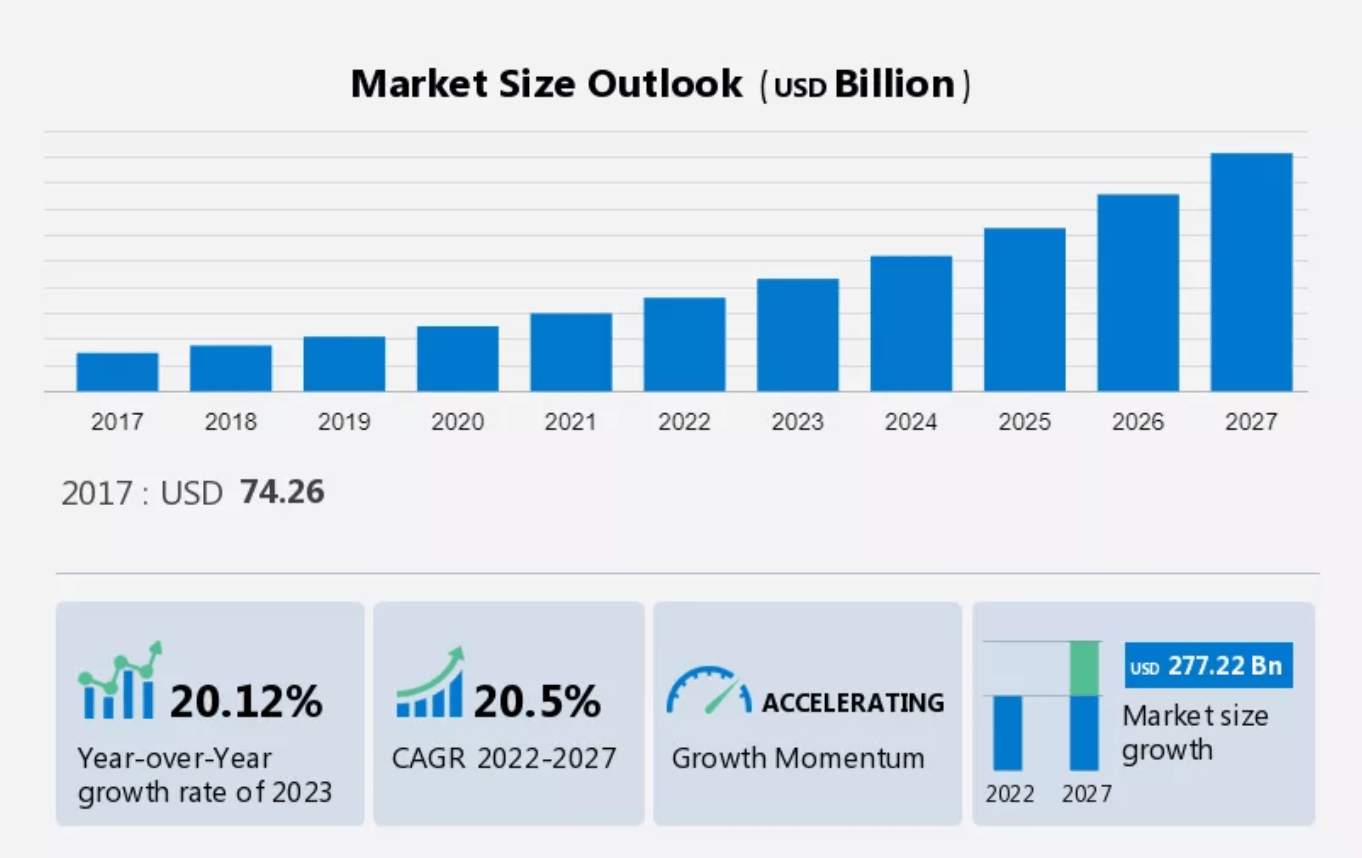

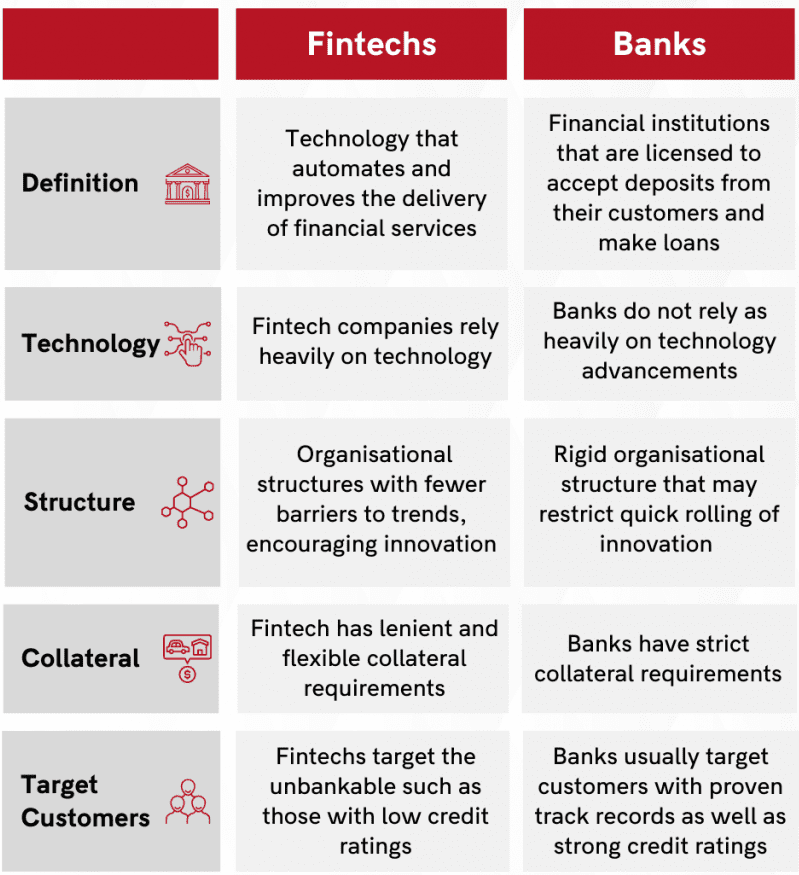

FinTech's ascendancy is reshaping the financial landscape, challenging the traditional banking sector with innovative solutions. With a projected annual revenue reaching $9.2 trillion by 2027, a nearly 95% increase in four years, FinTech's impact is undeniable. However, the banking industry is not standing still. This article explores how banks are responding to these challenges, potentially turning competition into collaboration.

The Unique Position of Banks in the FinTech Era

Despite FinTech's rapid growth, traditional banks hold significant advantages, including vast capital reserves, established customer bases, and deep regulatory expertise. These strengths, coupled with strategic investments in FinTech ventures, position banks to not only compete but also redefine their role in the financial ecosystem.

Related: How Open Banking is Shaping the Financial Ecosystem in 2024

Top 5 Challenges for Banks in the FinTech Revolution

-

Upgrading Legacy Mobile Banking Apps:

Traditional banks often grapple with outdated mobile apps. In contrast, FinTech offerings excel in usability and innovation, setting a high bar for customer expectations. Banks are now partnering with mobile FinTech software development firms to bridge this gap, combining financial insight with technical expertise. -

Personalized Customer Offers:

Utilizing AI and machine learning, banks can analyze vast data to tailor offers, moving beyond the "one-size-fits-all" approach. This personalization is key to retaining modern consumers who value individualized service. -

Embracing AI and Machine Learning:

The adoption of AI in banking, while challenging, is essential for staying competitive. Banks are increasingly seeking partnerships with FinTech innovators to integrate AI solutions, streamlining operations and enhancing customer service. -

Fostering User-Centered Innovation:

Banks must focus on customer-centric innovation to meet the diverse needs of their clientele. This includes developing targeted solutions for different demographics, leveraging their extensive data, and insights to offer relevant services. -

Managing Rising Costs:

Automation and FinTech collaborations offer pathways for banks to mitigate increasing operational costs. By leveraging technology, banks can enhance efficiency, reduce manual workload, and maintain competitive pricing.

The Synergy Between Traditional Banks and FinTech

The collaboration between banks and FinTech companies is not just a necessity but a strategic advantage. By combining resources, expertise, and technology, both sectors can thrive, offering customers innovative, efficient, and personalized banking experiences.

Conclusion

The intersection of traditional banking and FinTech presents both challenges and opportunities. For banks, embracing change, leveraging their inherent strengths, and strategically partnering with FinTech firms are key steps to staying relevant in the evolving financial landscape.

Need help building your mobile banking app? Contact us today.