Banking Customer Experience Excellence in 2024

The Ultimate Guide to Winning at Banking Customer Experience in 2024

In a world of endless financial choices, customer experience is the battlefield where banks win or lose customers. The old days of brick-and-mortar dominance are over. Today's customers expect seamless digital banking, a sprinkle of personalization, and unwavering security – all served effortlessly.

Are you ready to transform your bank into a customer experience powerhouse? Buckle up and let's dive in!

Understanding Why Customer Experience Matters

Customer experience (CX) is the lifeline of modern banking. Think of it this way:

- Happy customers = Loyal customers. A positive experience fosters trust and makes customers less likely to switch to a competitor.

- Delighted customers = Your marketing team. They spread the word, driving down acquisition costs.

The Evolution of Customer Experience in Banking

Let's take a quick trip down memory lane to see how far we've come:

- Traditional Banking: Long lines, limited hours, and a one-size-fits-all approach.

- Digital Revolution: Online banking and mobile apps brought convenience, but sometimes sacrificed the personal touch.

- The Hybrid Era (Today): The best of both worlds: digital convenience with humanized interactions for those who want it.

Related: Top Trends Disrupting the Banking Sector in 2024

Key Strategies to Enhance Banking Customer Experience

Ready to elevate your bank's CX? Focus on these areas:

Digital Transformation Masterclass

- Mobile Mastery: Intuitive, feature-rich mobile apps are a must-have. Offer remote check deposits, budgeting tools, and seamless transfers.

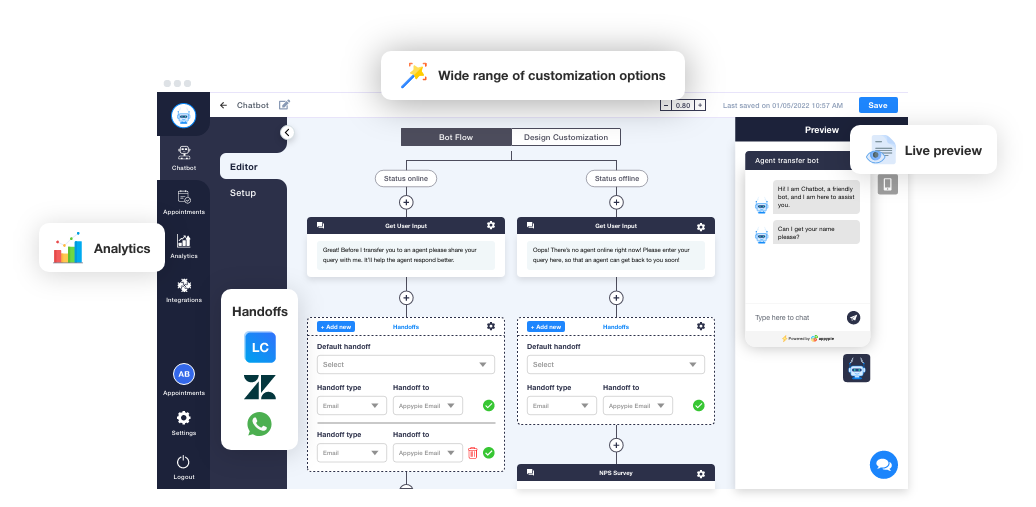

- AI Assistants: Deploy chatbots and virtual assistants to provide 24/7 support, answering common questions and resolving simple issues.

- Easy Onboarding: Digitize and streamline new account opening. Reduce wait times and improve first impressions.

Related: Customer Onboarding - Creating Accessible Banking Experiences

Personalization: The Secret Sauce

- Data = Power: Analyze customer behavior to predict needs and suggest relevant offers. Learn more about data analytics in banking.

- Individualized Attention: Tailor recommendations based on demographics and financial goals.

As far as fintech is concerned, neobanks have become popular for their focus on a particular niche audience. These are banks challenging traditional banks through hyper personalization. Learn more about how to build neobank apps.

Self-Service on Steroids

- Proactive Support: Provide step-by-step guides and tutorials for online banking.

- 24/7 Availability: Let customers manage basic tasks like bill pay and transfers at their convenience.

In 2024, and with all the variety in tools that help you enhancing banking customer experiences, you have no excuse not to immediately boost your own CX.

Emerging Trends Shaping the Future of Banking CX

Want to stay ahead of the game? Embrace these rising trends:

- AI's Expanding Role: Enhanced decision-making, stronger fraud detection, and hyper-personalized experiences.

- Conversational Banking: Chatbots and voice assistants provide a natural way for customers to interact.

- Frictionless Processes: Reduce wait times and streamline approvals for loans and accounts.

Related:

Optimize Your Strategies for Measurable Growth

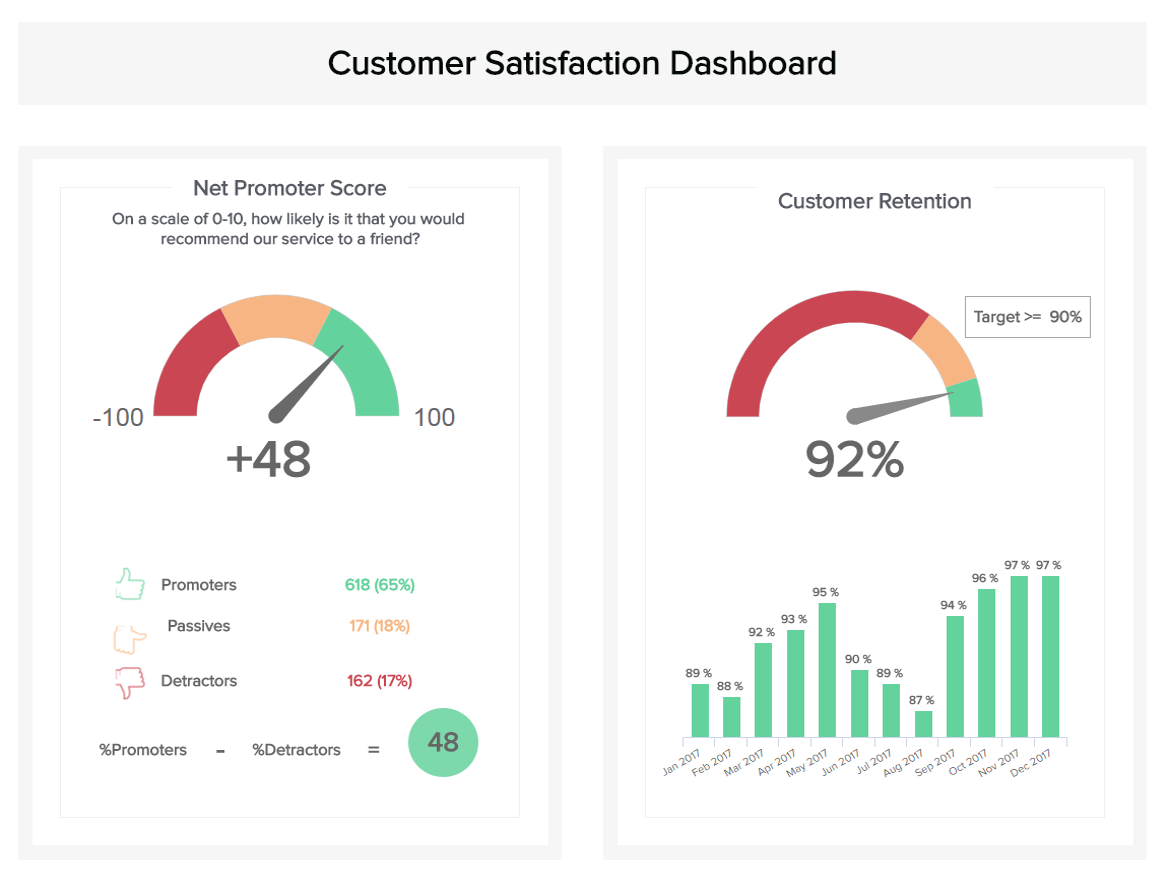

- Track Those Metrics: Use NPS surveys, website analytics, and app feedback to measure CX success and pinpoint areas for improvement.

- Build a Culture of CX: Train your staff to understand the importance of customer satisfaction.

- Proactive Problem Solving: Address negative feedback as soon as possible.

Challenges and How to Overcome Them

- Digital Transformation Hiccups: Invest in robust cybersecurity and prioritize seamless user experiences.

- Privacy vs. Personalization: Maintain transparency about data usage and offer customers control over their preferences. Learn more about GDPR compliance.

Related: KYC and Securing Your Customer's Banking Experience

FAQs

-

Q: How important is customer experience in banking, really?

-

A: It's the difference between being just another bank and being the bank customers rave about.

-

Q: How can I improve my bank's digital experience?

-

A: Focus on user-friendliness, reliability, and personalization.

Final Thoughts: Your bank's future hinges on delivering outstanding customer experiences. By embracing technology, prioritizing customers, and constantly innovating, you'll create a banking experience that wins hearts, minds, and wallets.

Ready to take your banking customer experience to the next level? Contact us today.

Additional Resources: CMS Guide for Saudi Financial Services: A Comprehensive Guide